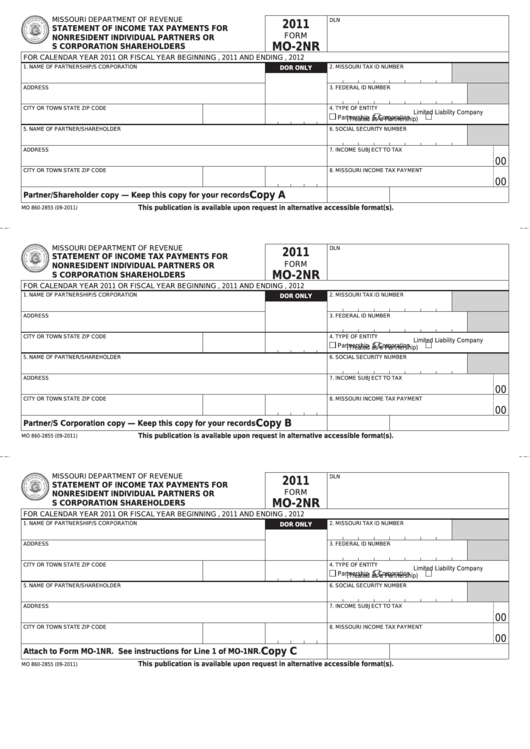

MISSOURI DEPARTMENT OF REVENUE

DLN

2011

Reset Form

Print Form

STATEMENT OF INCOME TAX PAYMENTS FOR

FORM

NONRESIDENT INDIVIDUAL PARTNERS OR

MO-2NR

S CORPORATION SHAREHOLDERS

FOR CALENDAR YEAR 2011 OR FISCAL YEAR BEGINNING

, 2011 AND ENDING

, 2012

1. NAME OF PARTNERSHIP/S CORPORATION

2. MISSOURI TAX ID NUMBER

DOR ONLY

ADDRESS

3. FEDERAL ID NUMBER

CITY OR TOWN

STATE

ZIP CODE

4. TYPE OF ENTITY

Limited Liability Company

Partnership

S Corporation

(Treated as a Partnership)

5. NAME OF PARTNER/SHAREHOLDER

6. SOCIAL SECURITY NUMBER

ADDRESS

7. INCOME SUBJECT TO TAX

00

CITY OR TOWN

STATE

ZIP CODE

8. MISSOURI INCOME TAX PAYMENT

00

Copy A

Partner/Shareholder copy — Keep this copy for your records

This publication is available upon request in alternative accessible format(s).

MO 860-2855 (09-2011)

MISSOURI DEPARTMENT OF REVENUE

DLN

2011

STATEMENT OF INCOME TAX PAYMENTS FOR

FORM

NONRESIDENT INDIVIDUAL PARTNERS OR

MO-2NR

S CORPORATION SHAREHOLDERS

FOR CALENDAR YEAR 2011 OR FISCAL YEAR BEGINNING

, 2011 AND ENDING

, 2012

1. NAME OF PARTNERSHIP/S CORPORATION

2. MISSOURI TAX ID NUMBER

DOR ONLY

ADDRESS

3. FEDERAL ID NUMBER

CITY OR TOWN

STATE

ZIP CODE

4. TYPE OF ENTITY

Limited Liability Company

Partnership

S Corporation

(Treated as a Partnership)

5. NAME OF PARTNER/SHAREHOLDER

6. SOCIAL SECURITY NUMBER

ADDRESS

7. INCOME SUBJECT TO TAX

00

CITY OR TOWN

STATE

ZIP CODE

8. MISSOURI INCOME TAX PAYMENT

00

Copy B

Partner/S Corporation copy — Keep this copy for your records

This publication is available upon request in alternative accessible format(s).

MO 860-2855 (09-2011)

MISSOURI DEPARTMENT OF REVENUE

DLN

2011

STATEMENT OF INCOME TAX PAYMENTS FOR

FORM

NONRESIDENT INDIVIDUAL PARTNERS OR

MO-2NR

S CORPORATION SHAREHOLDERS

FOR CALENDAR YEAR 2011 OR FISCAL YEAR BEGINNING

, 2011 AND ENDING

, 2012

1. NAME OF PARTNERSHIP/S CORPORATION

2. MISSOURI TAX ID NUMBER

DOR ONLY

ADDRESS

3. FEDERAL ID NUMBER

CITY OR TOWN

STATE

ZIP CODE

4. TYPE OF ENTITY

Limited Liability Company

Partnership

S Corporation

(Treated as a Partnership)

5. NAME OF PARTNER/SHAREHOLDER

6. SOCIAL SECURITY NUMBER

ADDRESS

7. INCOME SUBJECT TO TAX

00

CITY OR TOWN

STATE

ZIP CODE

8. MISSOURI INCOME TAX PAYMENT

00

Copy C

Attach to Form MO-1NR. See instructions for Line 1 of MO-1NR.

This publication is available upon request in alternative accessible format(s).

MO 860-2855 (09-2011)

1

1