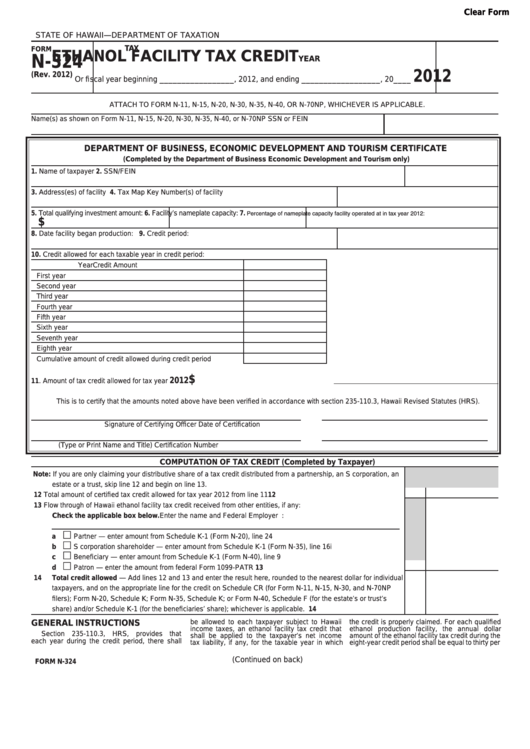

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

TAX

FORM

ETHANOL FACILITY TAX CREDIT

N-324

YEAR

2012

(Rev. 2012)

Or fiscal year beginning _________________, 2012, and ending __________________, 20____

ATTACH TO FORM N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP, WHICHEVER IS APPLICABLE.

Name(s) as shown on Form N-11, N-15, N-20, N-30, N-35, N-40, or N-70NP

SSN or FEIN

DEPARTMENT OF BUSINESS, ECONOMIC DEVELOPMENT AND TOURISM CERTIFICATE

(Completed by the Department of Business Economic Development and Tourism only)

1. Name of taxpayer

2. SSN/FEIN

3. Address(es) of facility

4. Tax Map Key Number(s) of facility

5. Total qualifying investment amount:

6. Facility’s nameplate capacity:

7. Percentage of nameplate capacity facility operated at in tax year 2012:

$

8. Date facility began production:

9. Credit period:

10. Credit allowed for each taxable year in credit period:

Year

Credit Amount

First year

Second year

Third year

Fourth year

Fifth year

Sixth year

Seventh year

Eighth year

Cumulative amount of credit allowed during credit period . . . . . . . .

$

2012 ..........................................................

11. Amount of tax credit allowed for tax year

This is to certify that the amounts noted above have been verified in accordance with section 235-110.3, Hawaii Revised Statutes (HRS).

Signature of Certifying Officer

Date of Certification

(Type or Print Name and Title)

Certification Number

COMPUTATION OF TAX CREDIT (Completed by Taxpayer)

Note: If you are only claiming your distributive share of a tax credit distributed from a partnership, an S corporation, an

estate or a trust, skip line 12 and begin on line 13.

12

12

Total amount of certified tax credit allowed for tax year 2012 from line 11 ..................................................................

13

Flow through of Hawaii ethanol facility tax credit received from other entities, if any:

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity:

a

Partner — enter amount from Schedule K-1 (Form N-20), line 24 ..................................................................

b

S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 16i .....................................

c

Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9 ..............................................................

d

13

Patron — enter the amount from federal Form 1099-PATR .............................................................................

14

Total credit allowed — Add lines 12 and 13 and enter the result here, rounded to the nearest dollar for individual

taxpayers, and on the appropriate line for the credit on Schedule CR (for Form N-11, N-15, N-30, and N-70NP

filers); Form N-20, Schedule K; Form N-35, Schedule K; or Form N-40, Schedule F (for the estate’s or trust’s

14

share) and/or Schedule K-1 (for the beneficiaries’ share); whichever is applicable. ..................................................

GENERAL INSTRUCTIONS

be allowed to each taxpayer subject to Hawaii

the credit is properly claimed. For each qualified

income taxes, an ethanol facility tax credit that

ethanol production facility, the annual dollar

Section 235-110.3, HRS, provides that

shall be applied to the taxpayer’s net income

amount of the ethanol facility tax credit during the

each year during the credit period, there shall

tax liability, if any, for the taxable year in which

eight-year credit period shall be equal to thirty per

(Continued on back)

FORM N-324

1

1 2

2