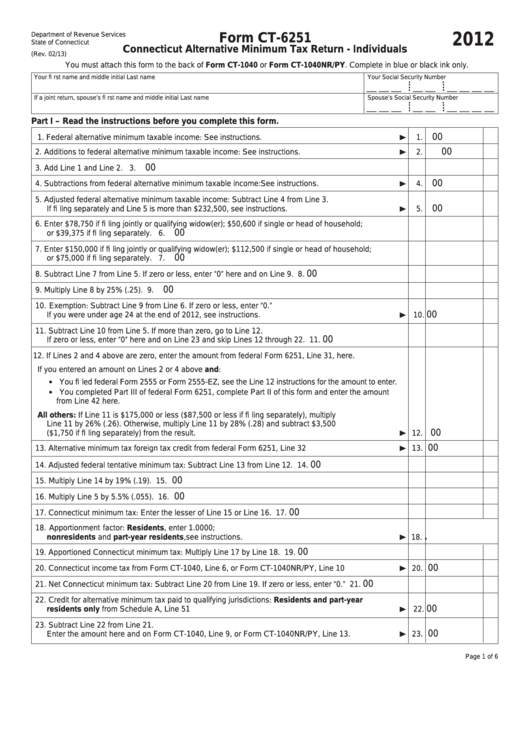

Form Ct-6251 - Connecticut Alternative Minimum Tax Return - Individuals - 2012

ADVERTISEMENT

Department of Revenue Services

2012

Form CT-6251

State of Connecticut

Connecticut Alternative Minimum Tax Return - Individuals

(Rev. 02/13)

You must attach this form to the back of Form CT-1040 or Form CT-1040NR/PY. Complete in blue or black ink only.

Your fi rst name and middle initial

Last name

Your Social Security Number

__ __ __

__ __ __ __ __ __

• •

• •

• •

• •

If a joint return, spouse’s fi rst name and middle initial

Last name

Spouse’s Social Security Number

__ __ __

__ __ __ __ __ __

• •

• •

• •

• •

Part I – Read the instructions before you complete this form.

00

1. Federal alternative minimum taxable income: See instructions.

1.

00

2. Additions to federal alternative minimum taxable income: See instructions.

2.

00

3. Add Line 1 and Line 2.

3.

00

4. Subtractions from federal alternative minimum taxable income: See instructions.

4.

5. Adjusted federal alternative minimum taxable income: Subtract Line 4 from Line 3.

00

If fi ling separately and Line 5 is more than $232,500, see instructions.

5.

6. Enter $78,750 if fi ling jointly or qualifying widow(er); $50,600 if single or head of household;

00

or $39,375 if fi ling separately.

6.

7. Enter $150,000 if fi ling jointly or qualifying widow(er); $112,500 if single or head of household;

00

or $75,000 if fi ling separately.

7.

00

8. Subtract Line 7 from Line 5. If zero or less, enter “0” here and on Line 9.

8.

00

9. Multiply Line 8 by 25% (.25).

9.

10. Exemption: Subtract Line 9 from Line 6. If zero or less, enter “0.”

00

If you were under age 24 at the end of 2012, see instructions.

10.

11. Subtract Line 10 from Line 5. If more than zero, go to Line 12.

00

If zero or less, enter “0” here and on Line 23 and skip Lines 12 through 22.

11.

12. If Lines 2 and 4 above are zero, enter the amount from federal Form 6251, Line 31, here.

If you entered an amount on Lines 2 or 4 above and:

You fi led federal Form 2555 or Form 2555-EZ, see the Line 12 instructions for the amount to enter.

You completed Part III of federal Form 6251, complete Part II of this form and enter the amount

from Line 42 here.

All others: If Line 11 is $175,000 or less ($87,500 or less if fi ling separately), multiply

Line 11 by 26% (.26). Otherwise, multiply Line 11 by 28% (.28) and subtract $3,500

00

($1,750 if fi ling separately) from the result.

12.

00

13. Alternative minimum tax foreign tax credit from federal Form 6251, Line 32

13.

00

14. Adjusted federal tentative minimum tax: Subtract Line 13 from Line 12.

14.

00

15. Multiply Line 14 by 19% (.19).

15.

00

16. Multiply Line 5 by 5.5% (.055).

16.

00

17. Connecticut minimum tax: Enter the lesser of Line 15 or Line 16.

17.

18. Apportionment factor: Residents, enter 1.0000;

.

nonresidents and part-year residents, see instructions.

18.

00

19. Apportioned Connecticut minimum tax: Multiply Line 17 by Line 18.

19.

00

20. Connecticut income tax from Form CT-1040, Line 6, or Form CT-1040NR/PY, Line 10

20.

00

21. Net Connecticut minimum tax: Subtract Line 20 from Line 19. If zero or less, enter “0.”

21.

22. Credit for alternative minimum tax paid to qualifying jurisdictions: Residents and part-year

00

residents only from Schedule A, Line 51

22.

23. Subtract Line 22 from Line 21.

00

Enter the amount here and on Form CT-1040, Line 9, or Form CT-1040NR/PY, Line 13.

23.

Page 1 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6