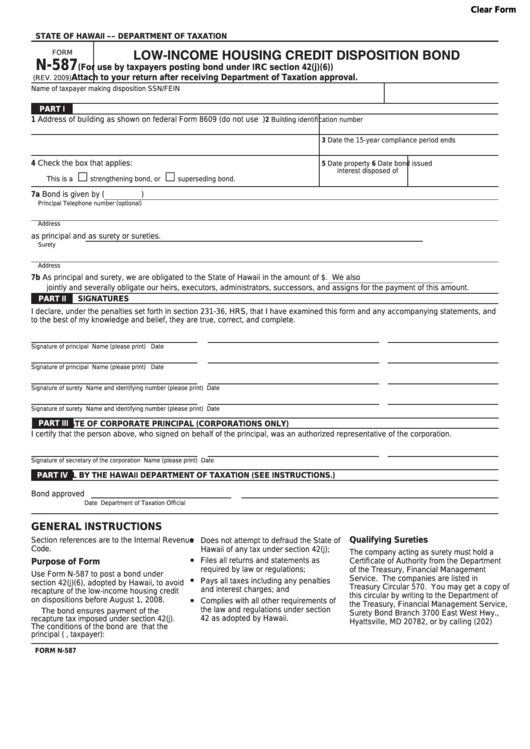

Clear Form

STATE OF HAWAII –– DEPARTMENT OF TAXATION

LOW-INCOME HOUSING CREDIT DISPOSITION BOND

FORM

N-587

(For use by taxpayers posting bond under IRC section 42(j)(6))

Attach to your return after receiving Department of Taxation approval.

(REV. 2009)

Name of taxpayer making disposition

SSN/FEIN

PART I

BONDING

1 Address of building as shown on federal Form 8609 (do not use P.O. box)

2 Building identification number

3 Date the 15-year compliance period ends

4

Check the box that applies:

5

Date property

6 Date bond issued

interest disposed of

This is a

strengthening bond, or

superseding bond.

7a Bond is given by

(

)

Principal

Telephone number (optional)

Address

as principal and

as surety or sureties.

Surety

Address

7b As principal and surety, we are obligated to the State of Hawaii in the amount of $

. We also

jointly and severally obligate our heirs, executors, administrators, successors, and assigns for the payment of this amount.

SIGNATuRES

PART II

I declare, under the penalties set forth in section 231-36, HRS, that I have examined this form and any accompanying statements, and

to the best of my knowledge and belief, they are true, correct, and complete.

Signature of principal

Name (please print)

Date

Signature of principal

Name (please print)

Date

Signature of surety

Name and identifying number (please print)

Date

Signature of surety

Name and identifying number (please print)

Date

PART III

CERTIFICATE OF CORPORATE PRINCIPAl (CORPORATIONS ONly)

I certify that the person above, who signed on behalf of the principal, was an authorized representative of the corporation.

Signature of secretary of the corporation

Name (please print)

Date

PART Iv

APPROvAl By THE HAWAII DEPARTMENT OF TAXATION (SEE INSTRuCTIONS.)

Bond approved

Date

Department of Taxation Official

GENERAl INSTRuCTIONS

•

Qualifying Sureties

Section references are to the Internal Revenue

Does not attempt to defraud the State of

Code.

Hawaii of any tax under section 42(j);

The company acting as surety must hold a

•

Files all returns and statements as

Purpose of Form

Certificate of Authority from the Department

required by law or regulations;

of the Treasury, Financial Management

Use Form N-587 to post a bond under

•

Service.

The companies are listed in

Pays all taxes including any penalties

section 42(j)(6), adopted by Hawaii, to avoid

Treasury Circular 570. You may get a copy of

and interest charges; and

recapture of the low-income housing credit

this circular by writing to the Department of

•

on dispositions before August 1, 2008.

Complies with all other requirements of

the Treasury, Financial Management Service,

the law and regulations under section

The bond ensures payment of the

Surety Bond Branch 3700 East West Hwy.,

42 as adopted by Hawaii.

recapture tax imposed under section 42(j).

Hyattsville, MD 20782, or by calling (202)

The conditions of the bond are that the

principal (i.e., taxpayer):

FORM N-587

1

1 2

2