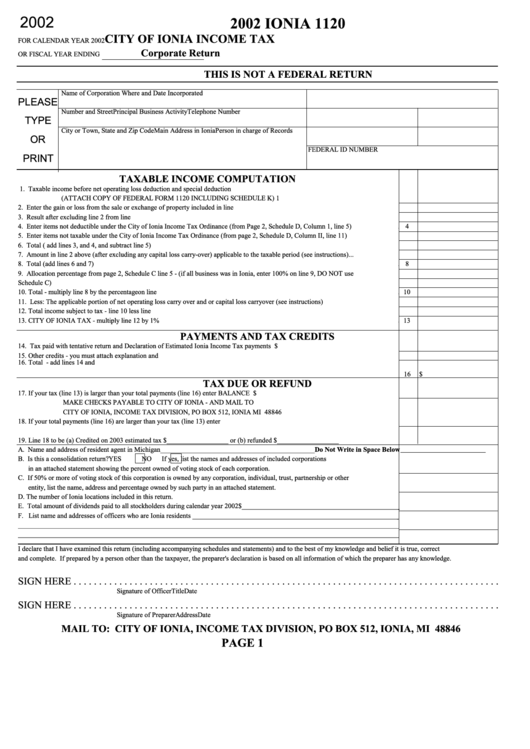

Form I-1120 - Income Tax Corporate Return - City Of Ionia - 2002

ADVERTISEMENT

2002

2002 IONIA 1120

CITY OF IONIA INCOME TAX

FOR CALENDAR YEAR 2002

Corporate Return

OR FISCAL YEAR ENDING

THIS IS NOT A FEDERAL RETURN

Name of Corporation

Where and Date Incorporated

PLEASE

Number and Street

Principal Business Activity

Telephone Number

TYPE

City or Town, State and Zip Code

Main Address in Ionia

Person in charge of Records

OR

FEDERAL ID NUMBER

PRINT

TAXABLE INCOME COMPUTATION

1. Taxable income before net operating loss deduction and special deduction

(ATTACH COPY OF FEDERAL FORM 1120 INCLUDING SCHEDULE K)........................................................................

1

2. Enter the gain or loss from the sale or exchange of property included in line 1.............................................................................................. 2

3. Result after excluding line 2 from line 1.......................................................................................................................................................... 3

4. Enter items not deductible under the City of Ionia Income Tax Ordinance (from Page 2, Schedule D, Column 1, line 5)............................. 4

5. Enter items not taxable under the City of Ionia Income Tax Ordinance (from page 2, Schedule D, Column II, line 11)............................... 5

6. Total ( add lines 3, and 4, and subtract line 5)................................................................................................................................................. 6

7. Amount in line 2 above (after excluding any capital loss carry-over) applicable to the taxable period (see instructions).............................. 7

8. Total (add lines 6 and 7)................................................................................................................................................................................... 8

9. Allocation percentage from page 2, Schedule C line 5 - (if all business was in Ionia, enter 100% on line 9, DO NOT use

Schedule C)..................................................................................................................................................................................................... 9

10. Total - multiply line 8 by the percentage on line 9.......................................................................................................................................... 10

11. Less: The applicable portion of net operating loss carry over and or capital loss carryover (see instructions)............................................. 11

12. Total income subject to tax - line 10 less line 11............................................................................................................................................ 12

13. CITY OF IONIA TAX - multiply line 12 by 1% ........................................................................................................................................... 13

PAYMENTS AND TAX CREDITS

14. Tax paid with tentative return and Declaration of Estimated Ionia Income Tax payments made.................................................................. 14

$

15. Other credits - you must attach explanation and support................................................................................................................................ 15

16. Total - add lines 14 and 15.............................................................................................................................................................................

16

$

TAX DUE OR REFUND

17. If your tax (line 13) is larger than your total payments (line 16) enter BALANCE DUE.............................................................................. 17 $

MAKE CHECKS PAYABLE TO CITY OF IONIA - AND MAIL TO

CITY OF IONIA, INCOME TAX DIVISION, PO BOX 512, IONIA MI 48846

18. If your total payments (line 16) are larger than your tax (line 13) enter OVERPAYMENT.......................................................................... 18

19. Line 18 to be (a) Credited on 2003 estimated tax $__________________ or (b) refunded $__________________

A. Name and address of resident agent in Michigan_____________________________________________

Do Not Write in Space Below

B. Is this a consolidation return?

YES

NO

If yes, list the names and addresses of included corporations

in an attached statement showing the percent owned of voting stock of each corporation.

C. If 50% or more of voting stock of this corporation is owned by any corporation, individual, trust, partnership or other

entity, list the name, address and percentage owned by such party in an attached statement.

D. The number of Ionia locations included in this return.

E. Total amount of dividends paid to all stockholders during calendar year 2002$_______________________________________________

F. List name and addresses of officers who are Ionia residents _____________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct

and complete. If prepared by a person other than the taxpayer, the preparer's declaration is based on all information of which the preparer has any knowledge.

SIGN HERE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Signature of Officer

Title

Date

SIGN HERE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Signature of Preparer

Address

Date

MAIL TO: CITY OF IONIA, INCOME TAX DIVISION, PO BOX 512, IONIA, MI 48846

PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2