Instructions For Schedule Kra - Tax Credit Computation Schedule For A Kra Project Of Corporations

ADVERTISEMENT

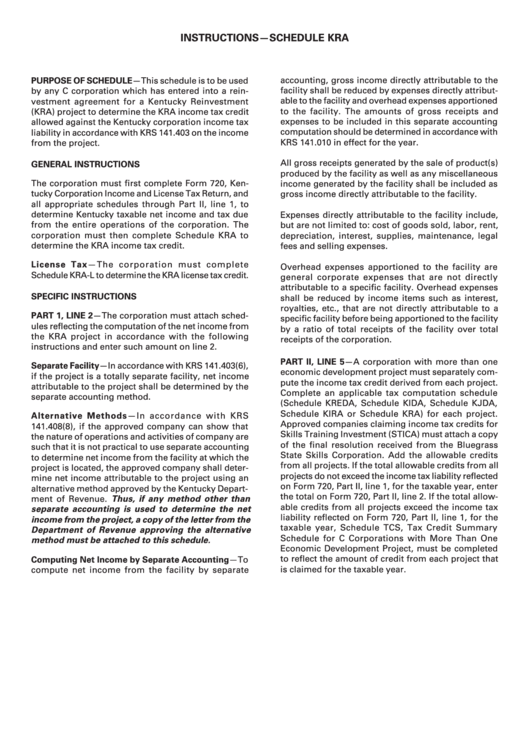

INSTRUCTIONS—SCHEDULE KRA

accounting, gross income directly attributable to the

PURPOSE OF SCHEDULE—This schedule is to be used

facility shall be reduced by expenses directly attribut-

by any C corporation which has entered into a rein-

able to the facility and overhead expenses apportioned

vestment agreement for a Kentucky Reinvestment

to the facility. The amounts of gross receipts and

(KRA) project to determine the KRA income tax credit

expenses to be included in this separate accounting

allowed against the Kentucky corporation income tax

computation should be determined in accordance with

liability in accordance with KRS 141.403 on the income

KRS 141.010 in effect for the year.

from the project.

All gross receipts generated by the sale of product(s)

GENERAL INSTRUCTIONS

produced by the facility as well as any miscellaneous

The corporation must first complete Form 720, Ken-

income generated by the facility shall be included as

tucky Corporation Income and License Tax Return, and

gross income directly attributable to the facility.

all appropriate schedules through Part II, line 1, to

determine Kentucky taxable net income and tax due

Expenses directly attributable to the facility include,

from the entire operations of the corporation. The

but are not limited to: cost of goods sold, labor, rent,

corporation must then complete Schedule KRA to

depreciation, interest, supplies, maintenance, legal

determine the KRA income tax credit.

fees and selling expenses.

License Tax—The corporation must complete

Overhead expenses apportioned to the facility are

Schedule KRA-L to determine the KRA license tax credit.

general corporate expenses that are not directly

attributable to a specific facility. Overhead expenses

SPECIFIC INSTRUCTIONS

shall be reduced by income items such as interest,

royalties, etc., that are not directly attributable to a

PART 1, LINE 2—The corporation must attach sched-

specific facility before being apportioned to the facility

ules reflecting the computation of the net income from

by a ratio of total receipts of the facility over total

the KRA project in accordance with the following

receipts of the corporation.

instructions and enter such amount on line 2.

PART II, LINE 5—A corporation with more than one

Separate Facility—In accordance with KRS 141.403(6),

economic development project must separately com-

if the project is a totally separate facility, net income

pute the income tax credit derived from each project.

attributable to the project shall be determined by the

Complete an applicable tax computation schedule

separate accounting method.

(Schedule KREDA, Schedule KIDA, Schedule KJDA,

Schedule KIRA or Schedule KRA) for each project.

Alternative Methods—In accordance with KRS

Approved companies claiming income tax credits for

141.408(8), if the approved company can show that

Skills Training Investment (STICA) must attach a copy

the nature of operations and activities of company are

of the final resolution received from the Bluegrass

such that it is not practical to use separate accounting

State Skills Corporation. Add the allowable credits

to determine net income from the facility at which the

from all projects. If the total allowable credits from all

project is located, the approved company shall deter-

projects do not exceed the income tax liability reflected

mine net income attributable to the project using an

on Form 720, Part II, line 1, for the taxable year, enter

alternative method approved by the Kentucky Depart-

the total on Form 720, Part II, line 2. If the total allow-

ment of Revenue. Thus, if any method other than

able credits from all projects exceed the income tax

separate accounting is used to determine the net

liability reflected on Form 720, Part II, line 1, for the

income from the project, a copy of the letter from the

taxable year, Schedule TCS, Tax Credit Summary

Department of Revenue approving the alternative

Schedule for C Corporations with More Than One

method must be attached to this schedule.

Economic Development Project, must be completed

to reflect the amount of credit from each project that

Computing Net Income by Separate Accounting—To

is claimed for the taxable year.

compute net income from the facility by separate

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1