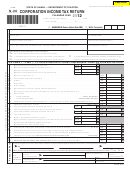

North Dakota Office of State Tax Commissioner

2012 Form 60, page 3

Enter name of corporation

FEIN

Schedule K

Total North Dakota adjustments, credits, and other items

distributable to shareholders

(All corporations must complete this schedule)

North Dakota subtraction adjustments

1

1 Interest from U.S. obligations

2

2 Renaissance zone business or investment income exemption

3

3 New or expanding business income exemption

North Dakota tax credits

4 Renaissance zone credit:

4a

a Renaissance zone: Historic property preservation or renovation tax credit

4b

b Renaissance zone: Renaissance fund organization investment tax credit

4c

c Renaissance zone: Nonparticipating property owner credit

5

5 Seed capital investment tax credit

6

6 Agricultural commodity processing facility investment tax credit

7

7 Supplier (wholesaler) biodiesel or green diesel fuel tax credit

8

8 Seller (retailer) biodiesel or green diesel fuel tax credit

9

9 Geothermal energy device tax credit - devices installed after December 31, 2008

10a

10 a Employer internship program tax credit

10b

b Number of eligible interns hired in 2012

10c

c Total compensation paid to eligible interns in 2012

11a

11 a Microbusiness tax credit

b Qualifying new investment

11b

11c

c Qualifying new employment

12a

12 a Research expense tax credit

12b

b Research expense tax credit purchased from another taxpayer

13a

13 a Endowment fund tax credit

13b

b Contribution amount on which the credit was based

14a

14 a Workforce recruitment credit

b Number of eligible employees whose 12th month of employment ended in 2011 14b

c Total compensation paid during the eligible employees' first 12 months of

employment ending in 2011

14c

15

15 Credit for wages paid to a mobilized employee

1

1 2

2 3

3 4

4 5

5