Reset

Print

State of Connecticut

File Only With

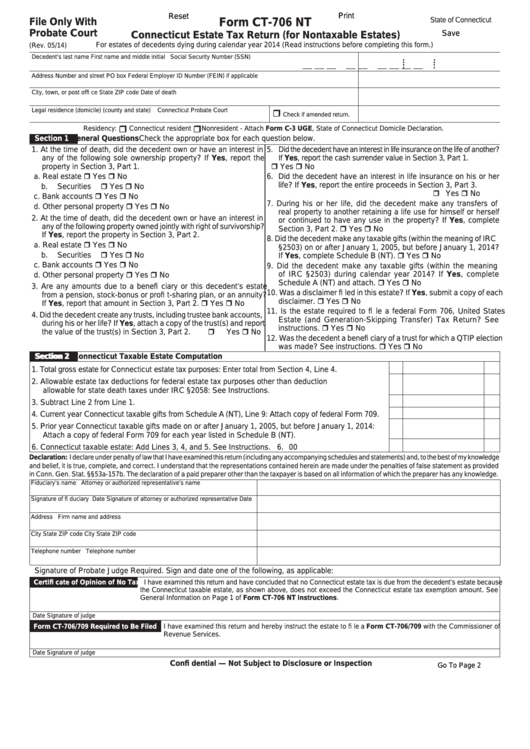

Form CT-706 NT

Probate Court

Save

Connecticut Estate Tax Return (for Nontaxable Estates)

For estates of decedents dying during calendar year 2014 (Read instructions before completing this form.)

(Rev. 05/14)

Decedent’s last name

First name and middle initial

Social Security Number (SSN)

• •

• •

• •

• •

__ __ __

__ __

__ __ __ __

Address

Number and street

PO box

Federal Employer ID Number (FEIN) if applicable

City, town, or post offi ce

State

ZIP code

Date of death

Legal residence (domicile) (county and state)

Connecticut Probate Court

Check if amended return.

Residency:

Connecticut resident

Nonresident - Attach Form C-3 UGE, State of Connecticut Domicile Declaration.

Section 1

General Questions Check the appropriate box for each question below.

1. At the time of death, did the decedent own or have an interest in

5. Did the decedent have an interest in life insurance on the life of another?

any of the following sole ownership property? If Yes, report the

If Yes, report the cash surrender value in Section 3, Part 1.

Yes

No

property in Section 3, Part 1.

Yes

No

a. Real estate

6. Did the decedent have an interest in life insurance on his or her

Yes

No

life? If Yes, report the entire proceeds in Section 3, Part 3.

b. Securities

Yes

No

Yes

No

c. Bank accounts

7. During his or her life, did the decedent make any transfers of

Yes

No

d. Other personal property

real property to another retaining a life use for himself or herself

2. At the time of death, did the decedent own or have an interest in

or continued to have any use in the property? If Yes, complete

any of the following property owned jointly with right of survivorship?

Yes

No

Section 3, Part 2.

If Yes, report the property in Section 3, Part 2.

8. Did the decedent make any taxable gifts (within the meaning of IRC

Yes

No

a. Real estate

§2503) on or after January 1, 2005, but before January 1, 2014?

Yes

No

Yes

No

b. Securities

If Yes, complete Schedule B (NT).

Yes

No

c. Bank accounts

9. Did the decedent make any taxable gifts (within the meaning

Yes

No

of IRC §2503) during calendar year 2014? If Yes, complete

d. Other personal property

Yes

No

Schedule A (NT) and attach.

3. Are any amounts due to a benefi ciary or this decedent’s estate

10. Was a disclaimer fi led in this estate? If Yes, submit a copy of each

from a pension, stock-bonus or profi t-sharing plan, or an annuity?

Yes

No

disclaimer.

Yes

No

If Yes, report that amount in Section 3, Part 2.

11. Is the estate required to fi le a federal Form 706, United States

4. Did the decedent create any trusts, including trustee bank accounts,

Estate (and Generation-Skipping Transfer) Tax Return? See

during his or her life? If Yes, attach a copy of the trust(s) and report

Yes

No

instructions.

Yes

No

the value of the trust(s) in Section 3, Part 2.

12. Was the decedent a benefi ciary of a trust for which a QTIP election

Yes

No

was made? See instructions.

Section 2

Section 2

Connecticut Taxable Estate Computation

1. Total gross estate for Connecticut estate tax purposes: Enter total from Section 4, Line 4. ........................ 1.

00

2. Allowable estate tax deductions for federal estate tax purposes other than deduction

allowable for state death taxes under IRC §2058: See Instructions. ........................................................ 2.

00

3. Subtract Line 2 from Line 1. ...................................................................................................................... 3.

00

4. Current year Connecticut taxable gifts from Schedule A (NT), Line 9: Attach copy of federal Form 709. .... 4.

00

5. Prior year Connecticut taxable gifts made on or after January 1, 2005, but before January 1, 2014:

Attach a copy of federal Form 709 for each year listed in Schedule B (NT). ............................................ 5.

00

6. Connecticut taxable estate: Add Lines 3, 4, and 5. See Instructions. ....................................................... 6.

00

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge

and belief, it is true, complete, and correct. I understand that the representations contained herein are made under the penalties of false statement as provided

in Conn. Gen. Stat. §§53a-157b. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Fiduciary’s name

Attorney or authorized representative’s name

Signature of fi duciary

Date

Signature of attorney or authorized representative

Date

Address

Firm name and address

City

State

ZIP code

City

State

ZIP code

Telephone number

Telephone number

Signature of Probate Judge Required. Sign and date one of the following, as applicable:

Certifi cate of Opinion of No Tax

I have examined this return and have concluded that no Connecticut estate tax is due from the decedent’s estate because

the Connecticut taxable estate, as shown above, does not exceed the Connecticut estate tax exemption amount. See

General Information on Page 1 of Form CT-706 NT Instructions.

Date

Signature of judge

Form CT-706/709 Required to Be Filed

I have examined this return and hereby instruct the estate to fi le a Form CT-706/709 with the Commissioner of

Revenue Services.

Date

Signature of judge

Confi dential — Not Subject to Disclosure or Inspection

Go To Page 2

1

1 2

2 3

3 4

4 5

5