Form Ct-249 - Claim For Long-Term Care Insurance Credit Page 2

ADVERTISEMENT

Instructions

Page 2 of 2 CT-249 (2012)

Temporary deferral of certain tax credits

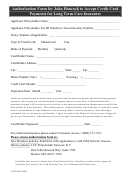

Lines 6 and 9 entries table

Section 1

For tax years beginning on or after January 1, 2010, and before

Franchise tax

Enter on line 6 any net

Enter on line 9 the

January 1, 2013, if the total amount of certain credits that you

return filed

recaptured tax credits

amount below

may use to reduce your tax or have refunded to you is greater

plus the amount from

than $2 million, the excess over $2 million must be deferred

to, and used or refunded in, tax years beginning on or after

Form CT-183, line 4 plus

Forms CT-183 and

75

January 1, 2013. For more information about the credit deferral,

Form CT-184, line 3 or 4

CT-184

see Form CT-500, Corporation Tax Credit Deferral.

Form CT-185

Line 6

10

Form CT-186

If you are subject to the credit deferral, you must complete all

Line 5

125

credit forms without regard to the deferral. However, the credit

Form CT-3

Line 78

Line 81 amount

amount that is transferred to your tax return to be applied against

Form CT-3-A

Line 77

Line 80 amount

your tax due or to be refunded to you may be reduced. Follow

Form CT-32

Line 5

250

the instructions for Form CT-500 to determine the amounts to

Form CT-32-A

enter on your tax return.

Line 5

250

Form CT-33

Line 11

250

General information

Form CT-33-A

Line 15

Line 4 plus line 12

Corporate taxpayers who pay premiums for qualifying long-term

Form CT-33-NL

Line 5

250

care insurance policies may claim a credit against the taxes

Section 2

imposed by Article 9, sections 183, 184, 185, 186, 186-a, and

186-e and Articles 9-A, 32, and 33. The credit is equal to 20% of

Tax return filed

Enter on line 6 any net

Enter on line 9 the

recaptured tax credits

the premiums paid during the tax year for the purchase of, or for

amount below

plus the amount from

continuing coverage under, a long-term care insurance policy that

qualifies for the credit pursuant to Insurance Law section 1117.

Form CT-186-E

Line 39 plus line 88

0

Individuals use Form IT-249, Claim for Long‑Term Care Insurance

Form CT-186-P

Line 4

0

Credit, to claim the credit.

A qualifying long-term care insurance policy is one that is:

Line 6 — Enter your tax before credits using the Lines 6 and 9

entries table above. The long-term care insurance credit can be

• approved by the New York State Superintendent of Insurance

pursuant to Insurance Law section 1117(g); or

applied to taxes as computed on the forms listed in the table

above. However, the credit cannot be applied against both a

• a group contract delivered or issued for delivery outside of

franchise tax return listed in Section 1 and a tax return listed in

New York State that is a qualified long-term care insurance

Section 2.

contract as defined in Internal Revenue Code (IRC)

section 7702B. (Note: IRC section 7702B relates to policies for

Line 7 — If you are claiming more than one tax credit for this

which a federal itemized deduction is allowed.)

year, enter the amount of credits claimed before applying this

credit. Otherwise enter 0. You must apply certain credits before

This credit is not refundable. However, any portion of the credit

the long-term care insurance credit. Refer to the instructions of

that cannot be applied to the tax for the current tax year may be

your franchise tax return to determine the order of credits that

carried forward indefinitely to the following tax year or years.

applies.

The credit may not reduce the tax to less than the following:

Article 9-A filers: Refer to Form CT-600-I, Instructions for

• the applicable minimum tax fixed by Article 9, section 183,

Form CT‑600, for the order of credits.

185, or 186

If you are included in a combined return, include any amount of

• the higher of the tax on minimum taxable income base or fixed

tax credits being claimed by other members of the combined

dollar minimum under Article 9-A

group, including the long-term care insurance credit, that you

• $250 under Article 32 or Article 33

wish to apply before your long-term care insurance credit.

Under Article 9, the credit must first be deducted from the taxes

CT-33 and CT-33-A filers, including unauthorized insurance

imposed by section 183, 185, or 186. Any credit remaining must

corporations: Do not enter on this line any amount of empire

then be deducted from the taxes imposed by section 184.

zone (EZ) wage tax credits, zone equivalent area (ZEA) wage

tax credits, or EZ capital tax credits you may be claiming. If you

The credit is not allowed against the metropolitan transportation

are included in a combined return, do not include any amount

business tax (MTA surcharge) under Article 9, 9-A, 32, or 33.

of these tax credit(s) being claimed by other members of the

combined group.

Line instructions

Line 9 — Enter the amount using the Lines 6 and 9 entries table

New York S corporations: Complete only lines 1 through

above.

5, and transfer the line 5 amount to the applicable line of

Form CT-34-SH, New York S Corporation Shareholders’

Line 11 — Enter the lesser of line 5 or line 10. If your total credits

Information Schedule.

from all sources are $2 million or less, enter the amount from

line 11 on your franchise tax return.

Line 3 — If you are a corporate partner receiving a long-term

care insurance credit from a partnership, include on line 3 your

If your total credits from all sources are more than $2 million,

pro-rata share of the long-term care insurance credit passed

you may be subject to the temporary credit deferral. Complete

through to you from the partnership.

line 11 but do not enter the amount from line 11 on your franchise

tax return. See Form CT-500 to determine the proper amounts to

Enter in the Partnership information area the name, identifying

enter on your franchise tax return.

number, and credit amount for each partnership that passed the

credit through to you.

Need help? and Privacy notification

See Form CT-1, Supplement to Corporation Tax Instructions.

497002120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2