Form S-Corp-Cr - New Mexico Tax Credit Schedule - 2012

ADVERTISEMENT

*125090200*

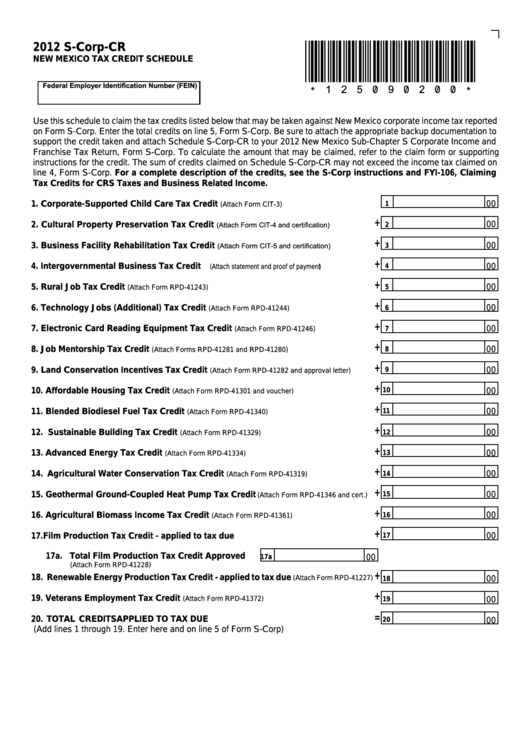

2012 S-Corp-CR

NEW MEXICO TAX CREDIT SCHEDULE

Federal Employer Identification Number (FEIN)

Use this schedule to claim the tax credits listed below that may be taken against New Mexico corporate income tax reported

on Form S-Corp. Enter the total credits on line 5, Form S-Corp. Be sure to attach the appropriate backup documentation to

support the credit taken and attach Schedule S-Corp-CR to your 2012 New Mexico Sub-Chapter S Corporate Income and

Franchise Tax Return, Form S-Corp. To calculate the amount that may be claimed, refer to the claim form or supporting

instructions for the credit. The sum of credits claimed on Schedule S-Corp-CR may not exceed the income tax claimed on

line 4, Form S-Corp. For a complete description of the credits, see the S-Corp instructions and FYI-106, Claiming

Tax Credits for CRS Taxes and Business Related Income.

1. Corporate-Supported Child Care Tax Credit

.................................

00

1

(Attach Form CIT-3)

+

(Attach Form CIT-4 and certification)

2. Cultural Property Preservation Tax Credit

.............

00

2

+

(Attach Form CIT-5 and certification)

3. Business Facility Rehabilitation Tax Credit

.............

00

3

+

4. Intergovernmental Business Tax Credit

..................

00

4

(Attach statement and proof of payment)

+

5. Rural Job Tax Credit

...............................................................

00

5

(Attach Form RPD-41243)

+

6. Technology Jobs (Additional) Tax Credit

..............................

00

6

(Attach Form RPD-41244)

+

7. Electronic Card Reading Equipment Tax Credit

...................

00

7

(Attach Form RPD-41246)

+

8. Job Mentorship Tax Credit

..............................

00

8

(Attach Forms RPD-41281 and RPD-41280)

+

9. Land Conservation Incentives Tax Credit

....

00

9

(Attach Form RPD-41282 and approval letter)

+

10. Affordable Housing Tax Credit

..............................

00

10

(Attach Form RPD-41301 and voucher)

+

11. Blended Biodiesel Fuel Tax Credit

........................................

11

00

(Attach Form RPD-41340)

+

12. Sustainable Building Tax Credit

.............................................

00

12

(Attach Form RPD-41329)

+

13. Advanced Energy Tax Credit

..................................................

00

13

(Attach Form RPD-41334)

+

14. Agricultural Water Conservation Tax Credit

.........................

00

14

(Attach Form RPD-41319)

+

15. Geothermal Ground-Coupled Heat Pump Tax Credit

00

15

(Attach Form RPD-41346 and cert.)

+

16. Agricultural Biomass Income Tax Credit

..............................

00

16

(Attach Form RPD-41361)

+

17. Film Production Tax Credit - applied to tax due .....................................................

00

17

17a. Total Film Production Tax Credit Approved......

17a

00

(Attach Form RPD-41228)

+

18. Renewable Energy Production Tax Credit - applied to tax due

(Attach Form RPD-41227)

00

18

+

19. Veterans Employment Tax Credit

..........................................

(Attach Form RPD-41372)

00

19

=

20. TOTAL CREDITS APPLIED TO TAX DUE .................................................................

00

20

(Add lines 1 through 19. Enter here and on line 5 of Form S-Corp)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1