Form S-Corp-Pv - New Mexico Sub Chapter-S Corporate Income And Franchise Tax Payment Voucher

ADVERTISEMENT

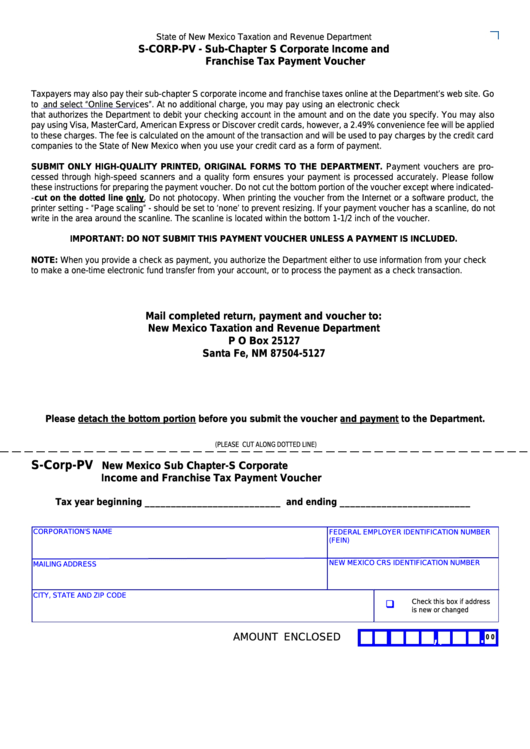

State of New Mexico Taxation and Revenue Department

S-CORP-PV - Sub-Chapter S Corporate Income and

Franchise Tax Payment Voucher

Taxpayers may also pay their sub-chapter S corporate income and franchise taxes online at the Department’s web site. Go

to

and select “Online Services”. At no additional charge, you may pay using an electronic check

that authorizes the Department to debit your checking account in the amount and on the date you specify. You may also

pay using Visa, MasterCard, American Express or Discover credit cards, however, a 2.49% convenience fee will be applied

to these charges. The fee is calculated on the amount of the transaction and will be used to pay charges by the credit card

companies to the State of New Mexico when you use your credit card as a form of payment.

SUBMIT ONLY HIGH-QUALITY PRINTED, ORIGINAL FORMS TO THE DEPARTMENT. Payment vouchers are pro-

cessed through high-speed scanners and a quality form ensures your payment is processed accurately. Please follow

these instructions for preparing the payment voucher. Do not cut the bottom portion of the voucher except where indicated-

-cut on the dotted line only. Do not photocopy. When printing the voucher from the Internet or a software product, the

printer setting - “Page scaling” - should be set to ‘none’ to prevent resizing. If your payment voucher has a scanline, do not

write in the area around the scanline. The scanline is located within the bottom 1-1/2 inch of the voucher.

IMPORTANT: DO NOT SUBMIT THIS PAYMENT VOUCHER UNLESS A PAYMENT IS INCLUDED.

NOTE: When you provide a check as payment, you authorize the Department either to use information from your check

to make a one-time electronic fund transfer from your account, or to process the payment as a check transaction.

Mail completed return, payment and voucher to:

New Mexico Taxation and Revenue Department

P O Box 25127

Santa Fe, NM 87504-5127

Please detach the bottom portion before you submit the voucher and payment to the Department.

(PLEASE CUT ALONG DOTTED LINE)

S-Corp-PV

New Mexico Sub Chapter-S Corporate

Income and Franchise Tax Payment Voucher

Tax year beginning __________________________ and ending _________________________

CORPORATION'S NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

(FEIN)

NEW MEXICO CRS IDENTIFICATION NUMBER

MAILING ADDRESS

CITY, STATE AND ZIP CODE

Check this box if address

is new or changed

,

,

.

AMOUNT ENCLOSED

0 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1