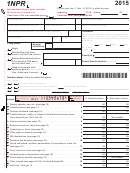

Page 4 of 4 IT-203 (2012)

Enter your social security number

.

59 Enter amount from line 58 ............................................................................................................ 59

00

Payments and refundable credits

(see page 38)

.

60 Part-year NYC school tax credit

...

60

(also complete E on front; see page 38)

00

.

61 Other refundable credits

...............

61

(Form IT-203-ATT, line 17)

00

Submit your wage and tax

.

62 Total New York State tax withheld .....................................

62

00

statements with your return

.

63 Total New York City tax withheld .......................................

63

00

(see page 38).

.

64 Total Yonkers tax withheld .................................................

64

00

.

65 Total estimated tax payments/amount paid with Form IT-370 ..

65

00

.

66 Total payments and refundable credits

............................................... 66

(add lines 60 through 65)

00

Your refund, amount you owe, and account information

(see pages 39 through 42)

.

67 Amount overpaid

.................................. 67

(if line 66 is more than line 59, subtract line 59 from line 66)

00

68 Amount of line 67 to be refunded

direct

debit

paper

.

Mark one refund choice:

deposit

card

check ...

68

(fill in line 73) - or -

- or -

00

69 Amount of line 67 that you want applied

See pages 39 and 40 for

.

information about your three

to your 2013 estimated tax

....................

69

(see instructions)

00

refund choices.

70 Amount you owe

.

(if line 66 is less than line 59, subtract line 66 from line 59)

.

To pay by electronic funds withdrawal, mark this box

and fill in lines 73 and 74 .............. 70

00

71 Estimated tax penalty

(include this amount on line 70,

See page 43 for the proper

.

............... 71

00

or reduce the overpayment on line 67; see page 40)

assembly of your return.

.

72 Other penalties and interest

72

(see page 40) ................................

00

73 Account information for direct deposit or electronic funds withdrawal

.

(see page 41)

If the funds for your payment (or refund) would come from (or go to) an account outside the U.S., mark an X in this box

(see pg. 41)

73a Account type:

Personal checking

- or -

Personal savings - or -

Business checking

- or -

Business savings

73b Routing number

73c Account number

.

74 Electronic funds withdrawal

00

(see page 41) ................................. Date

Amount

Print designee’s name

Designee’s phone number

Personal identification

Third-party

number (PIN)

designee?

(see instr.)

(

)

E-mail:

Yes

No

Date

Taxpayer(s) must sign here

Paid preparer must complete

(see instr.)

Your signature

Preparer’s signature

Preparer’s NYTPRIN

Your occupation

Firm’s name (or yours, if self-employed)

Preparer’s PTIN or SSN

Spouse’s signature and occupation (if joint return)

Address

Employer identification number

Daytime phone number

Date

Mark an X if

(

)

self-employed

E-mail:

E-mail:

See instructions for where to mail your return.

203004120094

1

1 2

2 3

3 4

4