Form Ab-123 - Distilled Spirits / Wine Permit Application

ADVERTISEMENT

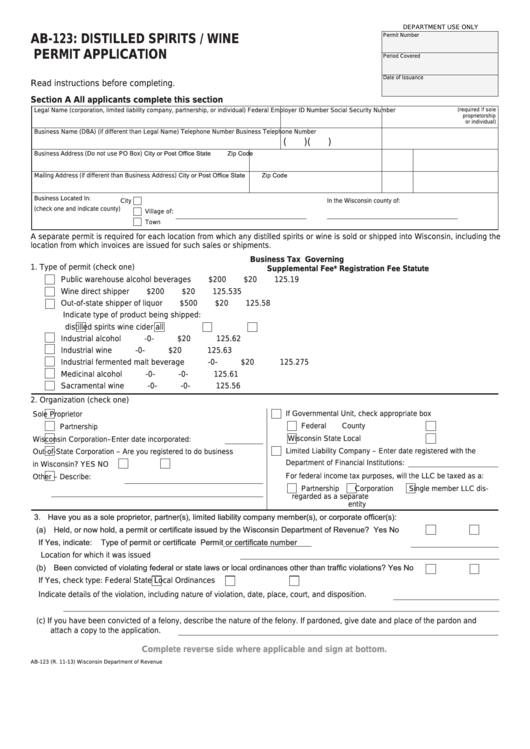

DEPARTMENT USE ONLY

Permit Number

AB-123: DISTILLED SPIRITS / WINE

PERMIT APPLICATION

Period Covered

Date of Issuance

Read instructions before completing.

Section A

All applicants complete this section

Legal Name (corporation, limited liability company, partnership, or individual)

Federal Employer ID Number

Social Security Number

(required if sole

proprietorship

or individual)

Business Name (DBA) (if different than Legal Name)

Telephone Number

Business Telephone Number

(

)

(

)

Business Address (Do not use PO Box)

City or Post Office

State

Zip Code

Mailing Address (if different than Business Address)

City or Post Office

State

Zip Code

Business Located In:

City

In the Wisconsin county of:

(check one and indicate county)

Village of:

Town

A separate permit is required for each location from which any distilled spirits or wine is sold or shipped into Wisconsin, including the

location from which invoices are issued for such sales or shipments.

Business Tax

Governing

1. Type of permit (check one)

Supplemental Fee *

Registration Fee

Statute

Public warehouse alcohol beverages . . . . . . . . . . . . . . . . . . . . . .

$200

$20

125.19

Wine direct shipper . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$200

$20

125.535

Out-of-state shipper of liquor . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$500

$20

125.58

Indicate type of product being shipped:

distilled spirits

wine

cider

all

Industrial alcohol . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

-0-

$20

125.62

Industrial wine . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

-0-

$20

125.63

Industrial fermented malt beverage . . . . . . . . . . . . . . . . . . . . . . .

-0-

$20

125.275

Medicinal alcohol . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

-0-

-0-

125.61

Sacramental wine . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

-0-

-0-

125.56

2. Organization (check one)

If Governmental Unit, check appropriate box

Sole Proprietor

Federal

County

Partnership

Wisconsin State

Local

Wisconsin Corporation – Enter date incorporated:

Limited Liability Company – Enter date registered with the

Out-of-State Corporation – Are you registered to do business

Department of Financial Institutions:

in Wisconsin?

YES

NO

For federal income tax purposes, will the LLC be taxed as a:

Other – Describe:

Partnership

Corporation

Single member LLC dis-

regarded as a separate

entity

3. Have you as a sole proprietor, partner(s), limited liability company member(s), or corporate officer(s):

(a) Held, or now hold, a permit or certificate issued by the Wisconsin Department of Revenue?

Yes

No

If Yes, indicate: Type of permit or certificate

Permit or certificate number

Location for which it was issued

(b) Been convicted of violating federal or state laws or local ordinances other than traffic violations?

Yes

No

If Yes, check type:

Federal

State

Local Ordinances

Indicate details of the violation, including nature of violation, date, place, court, and disposition.

(c)

If you have been convicted of a felony, describe the nature of the felony. If pardoned, give date and place of the pardon and

attach a copy to the application.

Complete reverse side where applicable and sign at bottom.

AB-123 (R. 11-13)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4