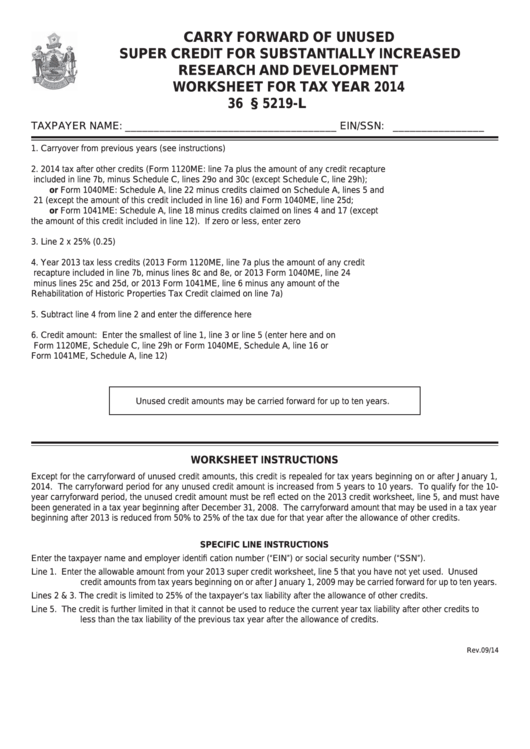

Carry Forward Of Unused Super Credit For Substantially Increased Research And Development Worksheet For Tax Year 2014

ADVERTISEMENT

CARRY FORWARD OF UNUSED

SUPER CREDIT FOR SUBSTANTIALLY INCREASED

RESEARCH AND DEVELOPMENT

WORKSHEET FOR TAX YEAR 2014

36 M.R.S. § 5219-L

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

1.

Carryover from previous years (see instructions) ................................................................... 1. __________________

2.

2014 tax after other credits (Form 1120ME: line 7a plus the amount of any credit recapture

included in line 7b, minus Schedule C, lines 29o and 30c (except Schedule C, line 29h);

or Form 1040ME: Schedule A, line 22 minus credits claimed on Schedule A, lines 5 and

21 (except the amount of this credit included in line 16) and Form 1040ME, line 25d;

or Form 1041ME: Schedule A, line 18 minus credits claimed on lines 4 and 17 (except

the amount of this credit included in line 12). If zero or less, enter zero ................................ 2. __________________

3.

Line 2 x 25% (0.25) ................................................................................................................. 3. __________________

4.

Year 2013 tax less credits (2013 Form 1120ME, line 7a plus the amount of any credit

recapture included in line 7b, minus lines 8c and 8e, or 2013 Form 1040ME, line 24

minus lines 25c and 25d, or 2013 Form 1041ME, line 6 minus any amount of the

Rehabilitation of Historic Properties Tax Credit claimed on line 7a) ....................................... 4. __________________

5.

Subtract line 4 from line 2 and enter the difference here ........................................................ 5. __________________

6.

Credit amount: Enter the smallest of line 1, line 3 or line 5 (enter here and on

Form 1120ME, Schedule C, line 29h or Form 1040ME, Schedule A, line 16 or

Form 1041ME, Schedule A, line 12) ....................................................................................... 6. __________________

Unused credit amounts may be carried forward for up to ten years.

WORKSHEET INSTRUCTIONS

Except for the carryforward of unused credit amounts, this credit is repealed for tax years beginning on or after January 1,

2014. The carryforward period for any unused credit amount is increased from 5 years to 10 years. To qualify for the 10-

year carryforward period, the unused credit amount must be refl ected on the 2013 credit worksheet, line 5, and must have

been generated in a tax year beginning after December 31, 2008. The carryforward amount that may be used in a tax year

beginning after 2013 is reduced from 50% to 25% of the tax due for that year after the allowance of other credits.

SPECIFIC LINE INSTRUCTIONS

Enter the taxpayer name and employer identifi cation number (“EIN”) or social security number (“SSN”).

Line 1.

Enter the allowable amount from your 2013 super credit worksheet, line 5 that you have not yet used. Unused

credit amounts from tax years beginning on or after January 1, 2009 may be carried forward for up to ten years.

Lines 2 & 3. The credit is limited to 25% of the taxpayer’s tax liability after the allowance of other credits.

Line 5.

The credit is further limited in that it cannot be used to reduce the current year tax liability after other credits to

less than the tax liability of the previous tax year after the allowance of credits.

Rev.09/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1