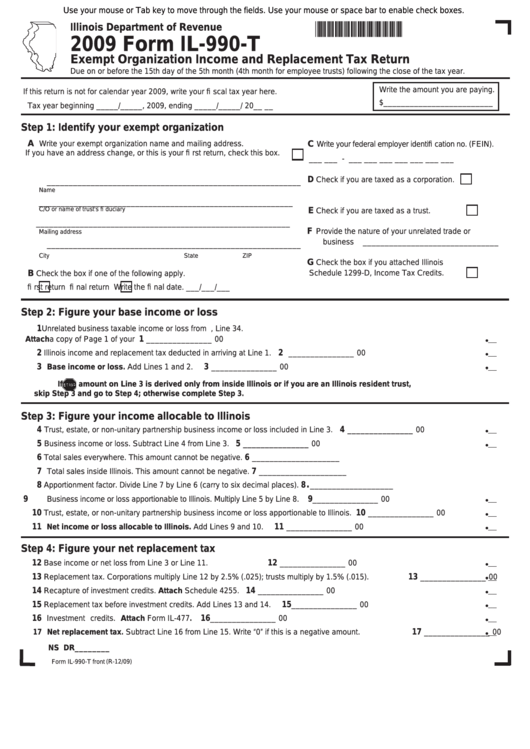

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*963601110*

Illinois Department of Revenue

2009 Form IL-990-T

Exempt Organization Income and Replacement Tax Return

Due on or before the 15th day of the 5th month (4th month for employee trusts) following the close of the tax year.

Write the amount you are paying.

If this return is not for calendar year 2009, write your fi scal tax year here.

$_________________________

Tax year beginning _____/_____, 2009, ending _____/_____/ 20__ __

Step 1: Identify your exempt organization

A

Write your exempt organization name and mailing address.

C

Write your federal employer identifi cation no. (FEIN).

If you have an address change, or this is your fi rst return, check this box.

___ ___ - ___ ___ ___ ___ ___ ___ ___

D

Check if you are taxed as a corporation.

__________________________________________________________

Name

__________________________________________________________

E

Check if you are taxed as a trust.

C/O or name of trust's fi duciary

__________________________________________________________

F

Provide the nature of your unrelated trade or

Mailing address

business _______________________________

__________________________________________________________

City

State

ZIP

G

Check the box if you attached Illinois

B

Schedule 1299-D, Income Tax Credits.

Check the box if one of the following apply.

fi rst return

fi nal return Write the fi nal date. ___/___/___

Step 2: Figure your base income or loss

1

Unrelated business taxable income or loss from U.S. Form 990-T, Line 34.

1

Attach a copy of Page 1 of your U.S. Form 990-T.

_______________ 00

2

2

Illinois income and replacement tax deducted in arriving at Line 1.

_______________ 00

3

3

Base income or loss. Add Lines 1 and 2.

_______________ 00

If the amount on Line 3 is derived only from inside Illinois or if you are an Illinois resident trust,

skip Step 3 and go to Step 4; otherwise complete Step 3.

Step 3: Figure your income allocable to Illinois

4

4

Trust, estate, or non-unitary partnership business income or loss included in Line 3.

_______________ 00

5

5

Business income or loss. Subtract Line 4 from Line 3.

_______________ 00

6

6

Total sales everywhere. This amount cannot be negative.

____________________

7

7

Total sales inside Illinois. This amount cannot be negative.

____________________

.

8

8

Apportionment factor. Divide Line 7 by Line 6 (carry to six decimal places).

___________________

9

9

Business income or loss apportionable to Illinois. Multiply Line 5 by Line 8.

_______________ 00

10

10

Trust, estate, or non-unitary partnership business income or loss apportionable to Illinois.

_______________ 00

11

11

Net income or loss allocable to Illinois. Add Lines 9 and 10.

_______________ 00

Step 4: Figure your net replacement tax

12

12

Base income or net loss from Line 3 or Line 11.

_______________ 00

13

13

Replacement tax. Corporations multiply Line 12 by 2.5% (.025); trusts multiply by 1.5% (.015).

_______________ 00

14

14

Recapture of investment credits. Attach Schedule 4255.

_______________ 00

15

15

Replacement tax before investment credits. Add Lines 13 and 14.

_______________ 00

16

16

Investment credits. Attach Form IL-477.

_______________ 00

17

17 Net replacement tax. Subtract Line 16 from Line 15. Write “0” if this is a negative amount.

_______________ 00

NS DR________

(R-12/09)

Form IL-990-T front

1

1 2

2