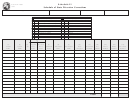

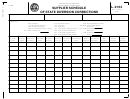

Instructions for Completing

Schedule of Diversions

Schedule 11

Column Instructions:

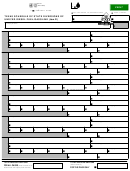

Who Should File This Schedule?

Columns 1 and 2: Enter the name and Federal Identification

All special fuel transported in a motor vehicle with a capacity of

more than five thousand four hundred (5,400) gallons must be

number (Fein) of the company that transports the fuel. This may

be you.

accompanied by a machine printed shipping paper/bill of lading

which includes the 1) name of the seller, 2) name of the purchaser,

3) type of fuel transported, 4) amount of fuel transported, 5) origin

Column 3: enter the mode of transport. One of the following

state and destination state of the load, 6) whether the fuel is dyed or

codes should be used for each entry

undyed, and 7) if the destination state is Indiana, the document must

J

= Truck

P L = Pipeline

state on its face the following: “indiana special fuel tax billed or

R = Rail

B

= Barge

collected by supplier or indiana special fuel tax billed or collected

ST = Stock Transfer

BA = Book Adjustment

by permissive supplier” or similar wording that has been approved

by the Department. Anytime an incorrect shipping paper has been

S

= Ship (Great Lakes or Ocean Marine Vessel)

issued or fuel is diverted from the original destination state, a

Column 4: enter the original destination state as printed on the

“diversion number” must be obtained from

Fuel

Trac. The diversion

manifest or bill of lading and the state to which the fuel is being

number and the corrected information must then be entered on the

diverted.

shipping paper before the fuel can be transported. This schedule

should reflect all loads of fuel that have been diverted during the

Column 5: enter the terminal code number assigned by the iRS

reporting period.

or BULK for bulk storage or BiO for biodiesel.

The diversion is to be reported by the company diverting the fuel.

Columns 6, 7, 8, and 9: Enter the purchaser’s information, the

The “diversion number” must be obtained before the diversion

date shipped, and the document number. Invoice numbers cannot

occurs. To obtain diversion numbers, contact

Failure to comply may result in penalties including fines and/or

be used in lieu of bill of lading or manifest number.

impoundment, seizure and subsequent sale of your cargo.

Column 10: enter the net gallons.

Before You Begin:

Column 11: enter the gross gallons.

Enter your identifying information as it is reflected on your Indiana

Column 12: enter the billed (invoiced) gallons. This should equal

Special Fuel License. Be certain to complete a separate schedule

either the net or the gross gallons.

for each fuel product type that you circle.

Column 13: enter the diversion number assigned to you by

Note: All loads of diverted fuel are to be reported on this schedule.

Fueltrac. if you have not obtained a diversion number for each

entry, contact

This includes tax paid purchases diverted to out-of-state locations

Fuel Trac

for further assistance.

and imports into Indiana from another state, tax unpaid.

1

1 2

2