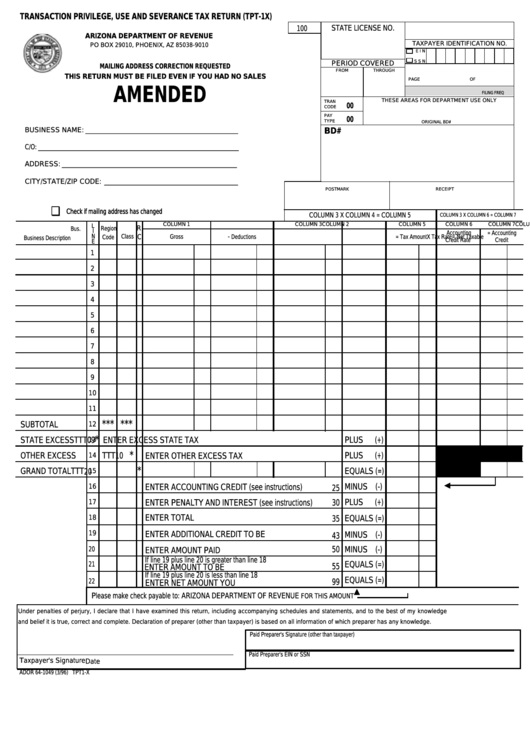

TRANSACTION PRIVILEGE, USE AND SEVERANCE TAX RETURN (TPT-1X)

.

STATE LICENSE NO

100

ARIZONA DEPARTMENT OF REVENUE

TAXPAYER IDENTIFICATION NO.

PO BOX 29010, PHOENIX, AZ 85038-9010

E I N

S S N

PERIOD COVERED

MAILING ADDRESS CORRECTION REQUESTED

FROM

THROUGH

THIS RETURN MUST BE FILED EVEN IF YOU HAD NO SALES

PAGE

OF

AMENDED

FILING FREQ

THESE AREAS FOR DEPARTMENT USE ONLY

TRAN

00

CODE

PAY

00

TYPE

ORIGINAL BD#

BUSINESS NAME: ________________________________________________

BD#

C/O: _______________________________________________________________

ADDRESS: _______________________________________________________

CITY/STATE/ZIP CODE: __________________________________________

POSTMARK

RECEIPT

Check if mailing address has changed

Check if mailing address has changed

COLUMN 3 X COLUMN 4 = COLUMN 5

COLUMN 3 X COLUMN 6 = COLUMN 7

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

COLUMN 6

COLUMN 7

L

R

Region

Bus.

I

Accounting

= Accounting

N

Class

C

-

=

Code

Gross

Deductions

Net Taxable

X Tax Rate

= Tax Amount

Business Description

Credit Rate

Credit

E

1

2

3

4

5

6

7

8

9

10

11

*** ***

SUBTOTAL

12

*

STATE EXCESS

13

TTT 09

ENTER EXCESS STATE TAX COLLECTED..........................

PLUS

(+)

*

OTHER EXCESS

14

TTT 10

ENTER OTHER EXCESS TAX COLLECTED.........................

PLUS

(+)

*

GRAND TOTAL

TTT 20

15

EQUALS (=)

16

ENTER ACCOUNTING CREDIT (see instructions).............

MINUS (-)

25

17

ENTER PENALTY AND INTEREST (see instructions)........

PLUS

(+)

30

ENTER TOTAL LIABILITY...................................................

18

35

EQUALS (=)

19

ENTER ADDITIONAL CREDIT TO BE USED.....................

MINUS (-)

43

50

20

MINUS (-)

ENTER AMOUNT PAID PREVIOUSLY...............................

If line 19 plus line 20 is greater than line 18

21

EQUALS (=)

55

ENTER AMOUNT TO BE REFUNDED................................

If line 19 plus line 20 is less than line 18

EQUALS (=)

22

99

ENTER NET AMOUNT YOU OWE......................................

Please make check payable to: ARIZONA DEPARTMENT OF REVENUE

FOR THIS AMOUNT

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Paid Preparer's Signature (other than taxpayer)

Paid Preparer's EIN or SSN

Taxpayer's Signature

Date

ADOR 64-1049 (3/96) TPT1-X

1

1 2

2