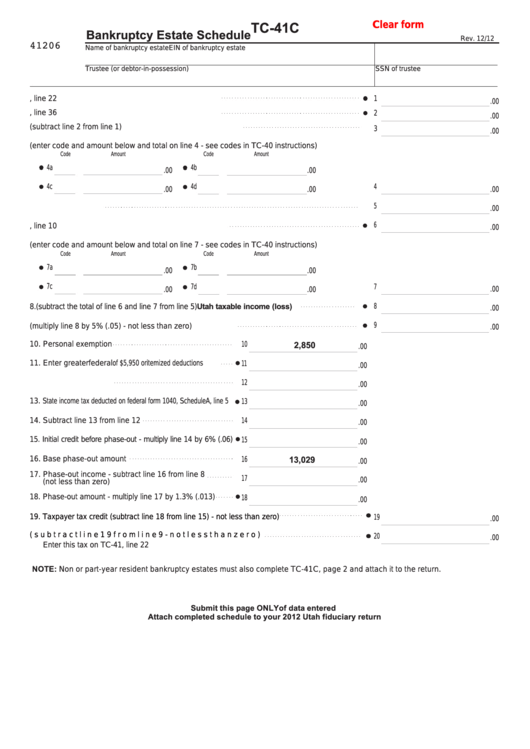

Clear form

TC-41C

Bankruptcy Estate Schedule

Rev. 12/12

41206

Name of bankruptcy estate

EIN of bankruptcy estate

Trustee (or debtor-in-possession)

SSN of trustee

1. Federal total income from federal form 1040, line 22

1

.00

2. Federal adjustments from federal form 1040, line 36

2

.00

3. Federal adjusted gross income (subtract line 2 from line 1)

3

.00

4. Additions to income (enter code and amount below and total on line 4 - see codes in TC-40 instructions)

Code

Amount

Code

Amount

4b

4a

.00

.00

4c

4d

4

.00

.00

.00

5

5. Add lines 3 and 4

.00

6

6. State tax refund included on federal form 1040, line 10

.00

7. Subtractions from income (enter code and amount below and total on line 7 - see codes in TC-40 instructions)

Code

Amount

Code

Amount

7a

7b

.00

.00

7c

7d

7

.00

.00

.00

8

.00

8.

Utah taxable income (loss)

(subtract the total of line 6 and line 7 from line 5)

9

.00

9. Utah tax (multiply line 8 by 5% (.05) - not less than zero)

10. Personal exemption

10

.00

2,850

11. Enter greater

of $5,950 or

federal

itemized deductions

11

.00

12. Add lines 10 and 11

12

.00

13. State income tax deducted on federal form 1040, Schedule A, line 5

13

.00

14. Subtract line 13 from line 12

14

.00

15. Initial credit before phase-out - multiply line 14 by 6% (.06)

15

.00

16. Base phase-out amount

16

.00

13,029

17. Phase-out income - subtract line 16 from line 8

.00

17

(not less than zero)

18. Phase-out amount - multiply line 17 by 1.3% (.013)

18

.00

19. Taxpayer tax credit (subtract line 18 from line 15) - not less than zero)

19

.00

20. Utah income tax (subtract line 19 from line 9 - not less than zero)

.00

20

Enter this tax on TC-41, line 22

NOTE: Non or part-year resident bankruptcy estates must also complete TC-41C, page 2 and attach it to the return.

Submit this page ONLY of data entered

Attach completed schedule to your 2012 Utah fiduciary return

1

1 2

2