Instructions For Form Ct-1120u - Unitary Corporation Business Tax Return - 2011

ADVERTISEMENT

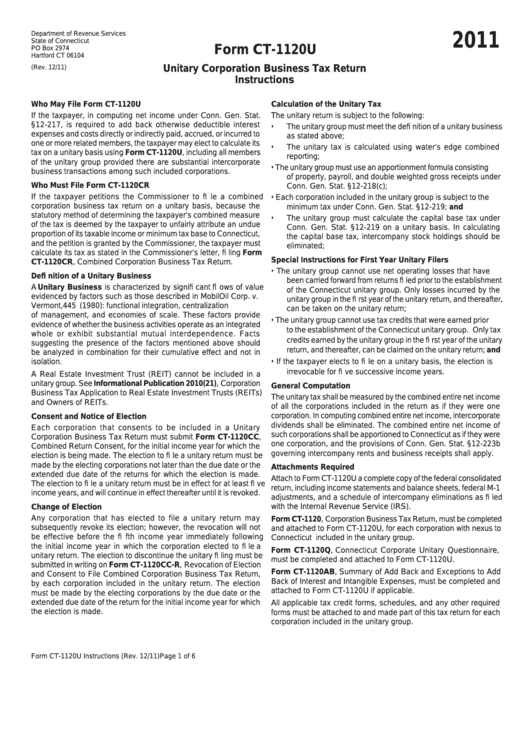

Department of Revenue Services

2011

State of Connecticut

Form CT-1120U

PO Box 2974

Hartford CT 06104

Unitary Corporation Business Tax Return

(Rev. 12/11)

Instructions

Who May File Form CT-1120U

Calculation of the Unitary Tax

If the taxpayer, in computing net income under Conn. Gen. Stat.

The unitary return is subject to the following:

§12-217, is required to add back otherwise deductible interest

• The unitary group must meet the defi nition of a unitary business

expenses and costs directly or indirectly paid, accrued, or incurred to

as stated above;

one or more related members, the taxpayer may elect to calculate its

• The unitary tax is calculated using water’s edge combined

tax on a unitary basis using Form CT-1120U, including all members

reporting;

of the unitary group provided there are substantial intercorporate

•

The unitary group must use an apportionment formula consisting

business transactions among such included corporations.

of property, payroll, and double weighted gross receipts under

Who Must File Form CT-1120CR

Conn. Gen. Stat. §12-218(c);

If the taxpayer petitions the Commissioner to fi le a combined

•

Each corporation included in the unitary group is subject to the

corporation business tax return on a unitary basis, because the

minimum tax under Conn. Gen. Stat. §12-219; and

statutory method of determining the taxpayer’s combined measure

• The unitary group must calculate the capital base tax under

of the tax is deemed by the taxpayer to unfairly attribute an undue

Conn. Gen. Stat. §12-219 on a unitary basis. In calculating

proportion of its taxable income or minimum tax base to Connecticut,

the capital base tax, intercompany stock holdings should be

and the petition is granted by the Commissioner, the taxpayer must

eliminated;

calculate its tax as stated in the Commissioner’s letter, fi ling Form

Special Instructions for First Year Unitary Filers

CT-1120CR, Combined Corporation Business Tax Return.

•

The unitary group cannot use net operating losses that have

Defi nition of a Unitary Business

been carried forward from returns fi led prior to the establishment

A Unitary Business is characterized by signifi cant fl ows of value

of the Connecticut unitary group. Only losses incurred by the

evidenced by factors such as those described in Mobil Oil Corp. v.

unitary group in the fi rst year of the unitary return, and thereafter,

Vermont, 445 U.S. 425 (1980): functional integration, centralization

can be taken on the unitary return;

of management, and economies of scale. These factors provide

•

The unitary group cannot use tax credits that were earned prior

evidence of whether the business activities operate as an integrated

to the establishment of the Connecticut unitary group. Only tax

whole or exhibit substantial mutual interdependence. Facts

credits earned by the unitary group in the fi rst year of the unitary

suggesting the presence of the factors mentioned above should

return, and thereafter, can be claimed on the unitary return; and

be analyzed in combination for their cumulative effect and not in

•

If the taxpayer elects to fi le on a unitary basis, the election is

isolation.

irrevocable for fi ve successive income years.

A Real Estate Investment Trust (REIT) cannot be included in a

unitary group. See Informational Publication 2010(21), Corporation

General Computation

Business Tax Application to Real Estate Investment Trusts (REITs)

The unitary tax shall be measured by the combined entire net income

and Owners of REITs.

of all the corporations included in the return as if they were one

corporation. In computing combined entire net income, intercorporate

Consent and Notice of Election

dividends shall be eliminated. The combined entire net income of

Each corporation that consents to be included in a Unitary

such corporations shall be apportioned to Connecticut as if they were

Corporation Business Tax Return must submit Form CT-1120CC,

one corporation, and the provisions of Conn. Gen. Stat. §12-223b

Combined Return Consent, for the initial income year for which the

governing intercompany rents and business receipts shall apply.

election is being made. The election to fi le a unitary return must be

made by the electing corporations not later than the due date or the

Attachments Required

extended due date of the returns for which the election is made.

Attach to Form CT-1120U a complete copy of the federal consolidated

The election to fi le a unitary return must be in effect for at least fi ve

return, including income statements and balance sheets, federal M-1

income years, and will continue in effect thereafter until it is revoked.

adjustments, and a schedule of intercompany eliminations as fi led

with the Internal Revenue Service (IRS).

Change of Election

Any corporation that has elected to file a unitary return may

Form CT-1120, Corporation Business Tax Return, must be completed

subsequently revoke its election; however, the revocation will not

and attached to Form CT-1120U, for each corporation with nexus to

be effective before the fi fth income year immediately following

Connecticut included in the unitary group.

the initial income year in which the corporation elected to fi le a

Form CT-1120Q, Connecticut Corporate Unitary Questionnaire,

unitary return. The election to discontinue the unitary fi ling must be

must be completed and attached to Form CT-1120U.

submitted in writing on Form CT-1120CC-R, Revocation of Election

Form CT-1120AB, Summary of Add Back and Exceptions to Add

and Consent to File Combined Corporation Business Tax Return,

Back of Interest and Intangible Expenses, must be completed and

by each corporation included in the unitary return. The election

attached to Form CT-1120U if applicable.

must be made by the electing corporations by the due date or the

extended due date of the return for the initial income year for which

All applicable tax credit forms, schedules, and any other required

the election is made.

forms must be attached to and made part of this tax return for each

corporation included in the unitary group.

Form CT-1120U Instructions (Rev. 12/11)

Page 1 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6