Reset Form

Print Form

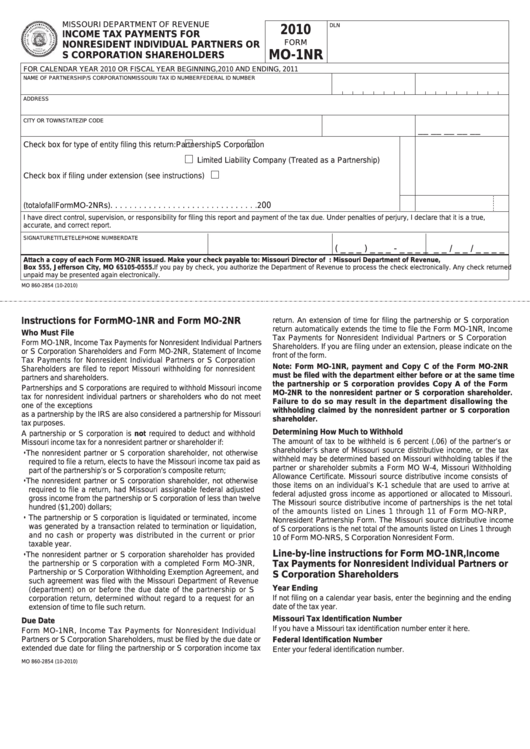

MISSOURI DEPARTMENT OF REVENUE

DLN

2010

INCOME TAX PAYMENTS FOR

FORM

NONRESIDENT INDIVIDUAL PARTNERS OR

MO-1NR

S CORPORATION SHAREHOLDERS

FOR CALENDAR YEAR 2010 OR FISCAL YEAR BEGINNING

,2010 AND ENDING

, 2011

NAME OF PARTNERSHIP/S CORPORATION

MISSOURI TAX ID NUMBER

FEDERAL ID NUMBER

ADDRESS

CITY OR TOWN

STATE

ZIP CODE

__ __ __ __ __

Check box for type of entity filing this return:

Partnership

S Corporation

Limited Liability Company (Treated as a Partnership)

Check box if filing under extension (see instructions)

1. Number of Form MO-2NRs attached . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2. Total Missouri income tax withheld (total of all Form MO-2NRs). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

I have direct control, supervision, or responsibility for filing this report and payment of the tax due. Under penalties of perjury, I declare that it is a true,

accurate, and correct report.

SIGNATURE

TITLE

TELEPHONE NUMBER

DATE

(_ _ _) _ _ _ - _ _ _ _ _ _ / _ _ / _ _ _ _

Attach a copy of each Form MO-2NR issued. Make your check payable to: Missouri Director of Revenue. Mail to: Missouri Department of Revenue, P.O.

Box 555, Jefferson City, MO 65105-0555. If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned

unpaid may be presented again electronically.

MO 860-2854 (10-2010)

Instructions for Form MO-1NR and Form MO-2NR

return. An extension of time for filing the partnership or S corporation

return automatically extends the time to file the Form MO-1NR, Income

Who Must File

Tax Payments for Nonresident Individual Partners or S Corporation

Form MO-1NR, Income Tax Payments for Nonresident Individual Partners

Shareholders. If you are filing under an extension, please indicate on the

or S Corporation Shareholders and Form MO-2NR, Statement of Income

front of the form.

Tax Payments for Nonresident Individual Partners or S Corporation

Note: Form MO-1NR, payment and Copy C of the Form MO-2NR

Shareholders are filed to report Missouri withholding for nonresident

must be filed with the department either before or at the same time

partners and shareholders.

the partnership or S corporation provides Copy A of the Form

Partnerships and S corporations are required to withhold Missouri income

MO-2NR to the nonresident partner or S corporation shareholder.

tax for nonresident individual partners or shareholders who do not meet

Failure to do so may result in the department disallowing the

one of the exceptions below. Limited liability companies that are treated

withholding claimed by the nonresident partner or S corporation

as a partnership by the IRS are also considered a partnership for Missouri

shareholder.

tax purposes.

Determining How Much to Withhold

A partnership or S corporation is not required to deduct and withhold

The amount of tax to be withheld is 6 percent (.06) of the partner’s or

Missouri income tax for a nonresident partner or shareholder if:

shareholder’s share of Missouri source distributive income, or the tax

• The nonresident partner or S corporation shareholder, not otherwise

withheld may be determined based on Missouri withholding tables if the

required to file a return, elects to have the Missouri income tax paid as

partner or shareholder submits a Form MO W-4, Missouri Withholding

part of the partnership’s or S corporation’s composite return;

Allowance Certificate. Missouri source distributive income consists of

• The nonresident partner or S corporation shareholder, not otherwise

those items on an individual’s K-1 schedule that are used to arrive at

required to file a return, had Missouri assignable federal adjusted

federal adjusted gross income as apportioned or allocated to Missouri.

gross income from the partnership or S corporation of less than twelve

The Missouri source distributive income of partnerships is the net total

hundred ($1,200) dollars;

of the amounts listed on Lines 1 through 11 of Form MO-NRP,

• The partnership or S corporation is liquidated or terminated, income

Nonresident Partnership Form. The Missouri source distributive income

was generated by a transaction related to termination or liquidation,

of S corporations is the net total of the amounts listed on Lines 1 through

and no cash or property was distributed in the current or prior

10 of Form MO-NRS, S Corporation Nonresident Form.

taxable year.

Line-by-line instructions for Form MO-1NR, Income

• The nonresident partner or S corporation shareholder has provided

Tax Payments for Nonresident Individual Partners or

the partnership or S corporation with a completed Form MO-3NR,

Partnership or S Corporation Withholding Exemption Agreement, and

S Corporation Shareholders

such agreement was filed with the Missouri Department of Revenue

Year Ending

(department) on or before the due date of the partnership or S

If not filing on a calendar year basis, enter the beginning and the ending

corporation return, determined without regard to a request for an

extension of time to file such return.

date of the tax year.

Missouri Tax Identification Number

Due Date

If you have a Missouri tax identification number enter it here.

Form MO-1NR, Income Tax Payments for Nonresident Individual

Partners or S Corporation Shareholders, must be filed by the due date or

Federal Identification Number

extended due date for filing the partnership or S corporation income tax

Enter your federal identification number.

MO 860-2854 (10-2010)

1

1 2

2