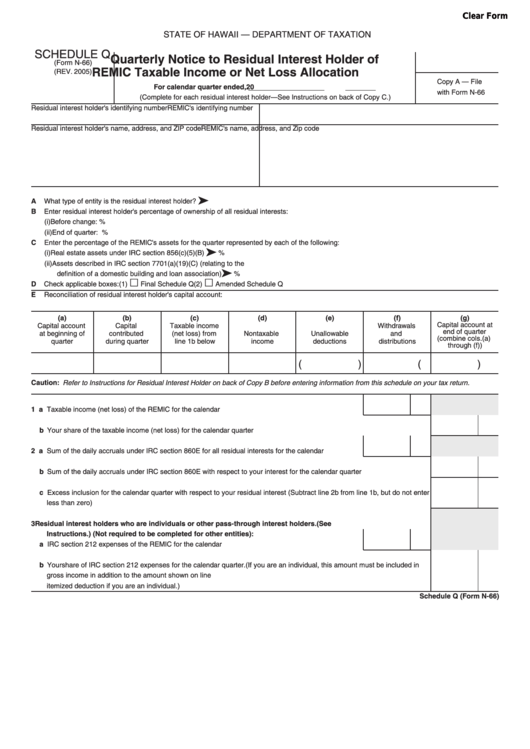

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

SCHEDULE Q

Quarterly Notice to Residual Interest Holder of

(Form N-66)

REMIC Taxable Income or Net Loss Allocation

(REV. 2005)

Copy A — File

For calendar quarter ended

,

20

with Form N-66

(Complete for each residual interest holder—See Instructions on back of Copy C.)

Residual interest holder's identifying number

REMIC's identifying number

Residual interest holder's name, address, and ZIP code

REMIC's name, address, and Zip code

ä

A

What type of entity is the residual interest holder?

......................................................................................

B

Enter residual interest holder's percentage of ownership of all residual interests:

(i) Before change: ...............%

(ii) End of quarter: ...............%

C

Enter the percentage of the REMIC's assets for the quarter represented by each of the following:

ä

(i) Real estate assets under IRC section 856(c)(5)(B)

...............%

(ii) Assets described in IRC section 7701(a)(19)(C) (relating to the

ä

definition of a domestic building and loan association)

...............%

£

£

D

Check applicable boxes: (1)

Final Schedule Q

(2)

Amended Schedule Q

E

Reconciliation of residual interest holder's capital account:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Capital account at

Capital account

Capital

Taxable income

Withdrawals

end of quarter

at beginning of

contributed

(net loss) from

Nontaxable

Unallowable

and

(combine cols. (a)

quarter

during quarter

line 1b below

income

deductions

distributions

through (f))

(

) (

)

Caution: Refer to Instructions for Residual Interest Holder on back of Copy B before entering information from this schedule on your tax return.

1 a Taxable income (net loss) of the REMIC for the calendar quarter ..............................................................

b Your share of the taxable income (net loss) for the calendar quarter ............................................................................................

2 a Sum of the daily accruals under IRC section 860E for all residual interests for the calendar quarter .......

b Sum of the daily accruals under IRC section 860E with respect to your interest for the calendar quarter ....................................

c Excess inclusion for the calendar quarter with respect to your residual interest (Subtract line 2b from line 1b, but do not enter

less than zero)................................................................................................................................................................................

3

Residual interest holders who are individuals or other pass-through interest holders. (See

Instructions.) (Not required to be completed for other entities):

a IRC section 212 expenses of the REMIC for the calendar quarter .............................................................

b Your share of IRC section 212 expenses for the calendar quarter. (If you are an individual, this amount must be included in

gross income in addition to the amount shown on line 1b. See Instruction for treatment of this amount as a miscellaneous

itemized deduction if you are an individual.) ..................................................................................................................................

Schedule Q (Form N-66)

1

1 2

2 3

3 4

4 5

5 6

6