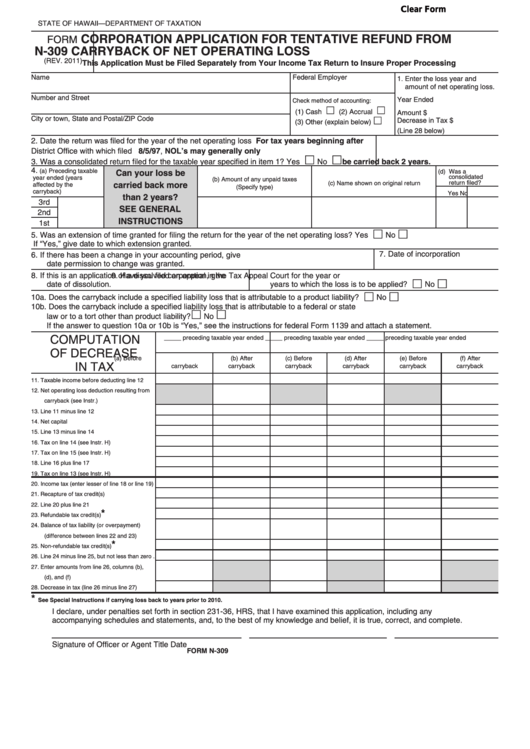

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

CORPORATION APPLICATION FOR TENTATIVE REFUND FROM

FORM

N-309

CARRYBACK OF NET OPERATING LOSS

This Application Must be Filed Separately from Your Income Tax Return to Insure Proper Processing

(REV. 2011)

Name

Federal Employer I.D. No.

1. Enter the loss year and

amount of net operating loss.

Number and Street

Year Ended ................................

Check method of accounting:

(1) Cash

(2) Accrual

Amount $ ...................................

City or town, State and Postal/ZIP Code

(3) Other (explain below)

Decrease in Tax $ ......................

(Line 28 below)

Date the return was filed for the year of the net operating loss ..................................................... For tax years beginning after

2.

District Office with which filed ........................................................................................................ 8/5/97, NOL’s may generally only

be carried back 2 years.

3.

Was a consolidated return filed for the taxable year specified in item 1?

Yes

No

4.

Can your loss be

(a) Preceding taxable

(d) Was a

consolidated

year ended (years

(b) Amount of any unpaid taxes

carried back more

return filed?

(c) Name shown on original return

affected by the

(Specify type)

carryback)

Yes

No

than 2 years?

3rd ...........................................................................................................................................................................................................

SEE GENERAL

2nd ...........................................................................................................................................................................................................

INSTRUCTIONS

1st

5.

Was an extension of time granted for filing the return for the year of the net operating loss?

Yes

No

If “Yes,” give date to which extension granted.

7.

Date of incorporation

6.

If there has been a change in your accounting period, give

date permission to change was granted.

8.

If this is an application of a dissolved corporation, give

9.

Have you filed an appeal in the Tax Appeal Court for the year or

date of dissolution.

years to which the loss is to be applied? ....... Yes

No

10a. Does the carryback include a specified liability loss that is attributable to a product liability? ..............................Yes

No

10b. Does the carryback include a specified liability loss that is attributable to a federal or state

law or to a tort other than product liability? ...........................................................................................................Yes

No

If the answer to question 10a or 10b is “Yes,” see the instructions for federal Form 1139 and attach a statement.

COMPUTATION

_____ preceding taxable year ended

_____ preceding taxable year ended

_____ preceding taxable year ended

OF DECREASE

(a) Before

(b) After

(c) Before

(d) After

(e) Before

(f) After

IN TAX

carryback

carryback

carryback

carryback

carryback

carryback

11. Taxable income before deducting line 12 ......

12. Net operating loss deduction resulting from

carryback (see Instr.) .....................................

13. Line 11 minus line 12 ....................................

14. Net capital gain..............................................

15. Line 13 minus line 14 ....................................

16. Tax on line 14 (see Instr. H) ...........................

17. Tax on line 15 (see Instr. H) ...........................

18. Line 16 plus line 17 .......................................

19. Tax on line 13 (see Instr. H) ...........................

20. Income tax (enter lesser of line 18 or line 19) ....

21. Recapture of tax credit(s) ..............................

22. Line 20 plus line 21 .......................................

*

23. Refundable tax credit(s)

..............................

24. Balance of tax liability (or overpayment)

(difference between lines 22 and 23) ............

*

25. Non-refundable tax credit(s)

.......................

26. Line 24 minus line 25, but not less than zero ..

27. Enter amounts from line 26, columns (b),

(d), and (f)......................................................

28. Decrease in tax (line 26 minus line 27) ........

*

See Special Instructions if carrying loss back to years prior to 2010.

I declare, under penalties set forth in section 231-36, HRS, that I have examined this application, including any

accompanying schedules and statements, and, to the best of my knowledge and belief, it is true, correct, and complete.

Signature of Officer or Agent

Title

Date

FORM N-309

1

1 2

2