Reset Form

Print Form

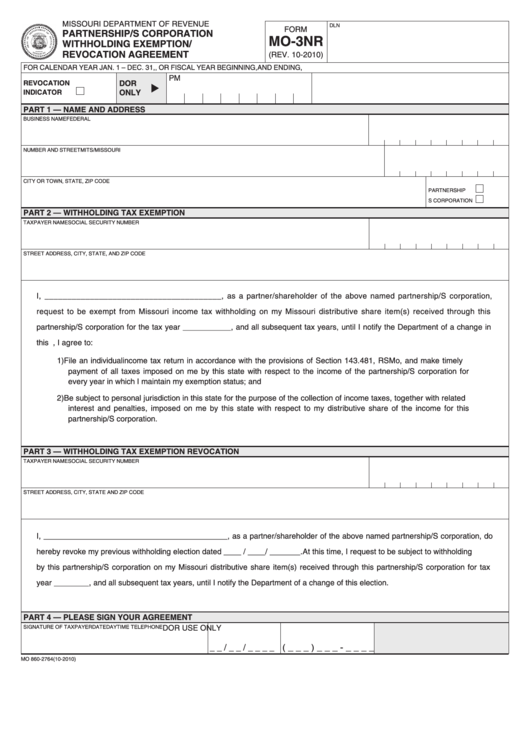

MISSOURI DEPARTMENT OF REVENUE

DLN

FORM

PARTNERSHIP/S CORPORATION

MO-3NR

WITHHOLDING EXEMPTION/

REVOCATION AGREEMENT

(REV. 10-2010)

FOR CALENDAR YEAR JAN. 1 – DEC. 31,

, OR FISCAL YEAR BEGINNING

,

AND ENDING

,

PM

REVOCATION

DOR

INDICATOR

ONLY

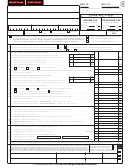

PART 1 — NAME AND ADDRESS

BUSINESS NAME

FEDERAL I.D. NUMBER

NUMBER AND STREET

MITS/MISSOURI I.D. NUMBER

CITY OR TOWN, STATE, ZIP CODE

PARTNERSHIP

S CORPORATION

PART 2 — WITHHOLDING TAX EXEMPTION

TAXPAYER NAME

SOCIAL SECURITY NUMBER

STREET ADDRESS, CITY, STATE, AND ZIP CODE

I, _______________________________________, as a partner/shareholder of the above named partnership/S corporation,

request to be exempt from Missouri income tax withholding on my Missouri distributive share item(s) received through this

partnership/S corporation for the tax year ___________, and all subsequent tax years, until I notify the Department of a change in

this election. By signing this agreement, I agree to:

1) File an individual income tax return in accordance with the provisions of Section 143.481, RSMo, and make timely

payment of all taxes imposed on me by this state with respect to the income of the partnership/S corporation for

every year in which I maintain my exemption status; and

2) Be subject to personal jurisdiction in this state for the purpose of the collection of income taxes, together with related

interest and penalties, imposed on me by this state with respect to my distributive share of the income for this

partnership/S corporation.

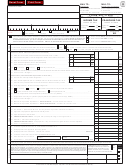

PART 3 — WITHHOLDING TAX EXEMPTION REVOCATION

TAXPAYER NAME

SOCIAL SECURITY NUMBER

STREET ADDRESS, CITY, STATE AND ZIP CODE

I, __________________________________________, as a partner/shareholder of the above named partnership/S corporation, do

hereby revoke my previous withholding election dated ____ / ____/ _______. At this time, I request to be subject to withholding

by this partnership/S corporation on my Missouri distributive share item(s) received through this partnership/S corporation for tax

year ________, and all subsequent tax years, until I notify the Department of a change of this election.

PART 4 — PLEASE SIGN YOUR AGREEMENT

SIGNATURE OF TAXPAYER

DATE

DAYTIME TELEPHONE

DOR USE ONLY

_ _ / _ _ / _ _ _ _ (_ _ _) _ _ _ - _ _ _ _

MO 860-2764 (10-2010)

1

1 2

2