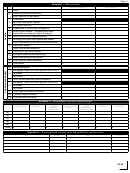

for reporting such payments may be used for reporting the required

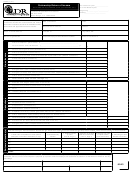

Line 7

Rents and Royalties — Print on Line 7 the net income (or

loss) as reported on Schedule B.

information. Federal Form 1099 shall be accompanied by Federal

Form 1096 furnishing the payor’s name, address, Federal Employer

Line 8

Net Farm Profit (or Loss) — Print the net profit (or loss)

Identification Number, and/or Social Security Number and the number

from farming. Attach schedule explaining determination of

of Forms 1099 enclosed. Informational returns reporting other items of

profit or loss.

income that would normally appear on Federal Form 1099 are required

only upon the specific request of the Secretary of Revenue.

Line 9

Profit or Loss from the Sale of Capital Assets such as Stocks,

Bonds, Real Estate, etc. — Print the profit from the sale of

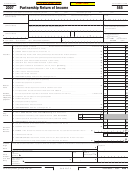

Gross income and deductions

property, including property situated outside of Louisiana, as

Line 1

Gross Sales — Print the gross sales, less goods returned, and any

reported on Schedule D of the return.

allowance or discounts from the sale price if engaged in business

Describe the property briefly using Schedule D; give location,

where inventories are an income-determining factor.

and state the actual consideration of price received, or the fair

market value of the property received in exchange. Expenses

Line 2

Cost of Goods Sold — Print the cost of goods sold as

connected with the sale, such as commissions paid agents, may

determined on Schedule A on Page 2 of the return.

be deducted in computing the amount received.

If the production, purchase, or sale of merchandise is an

If a gain or a loss is computed on the sale of property acquired

income-producing factor in the trade or business, inventories

before January 1, 1934, both the cost and the acquired value

of the merchandise on hand should be taken at the beginning

must be shown with information as to how the January 1,

and end of the taxable year. The inventories may be valued

1934, value was determined, as provided by R.S. 47:155. If

using either the cost method, or the lower of cost or market

the amount shown as cost is other than actual cash cost of

method. If the inventories reported do not agree with the

the property sold, full details must be furnished regarding the

inventories in the records, attach a statement explaining how

acquisition of the property.

the difference occurred.

Enter as depreciation, the amount of exhaustion, wear and

Line 3

Gross Profit from Sales — Print on Line 3 the gross profit,

tear, obsolescence, or depletion that has been allowed (but

that is obtained by deducting Line 2, the cost of goods sold

not less than the amount allowable) in respect to such

as extended, from Line 1, the gross sales.

property since date of acquisition, or since January 1, 1934,

if the property was acquired before that date. In addition,

If the installment method is used, attach a schedule to the

if the property was acquired before January 1, 1934, and if

return showing the following information separately for

the cost of such property is greater than its fair market value

the current year and each of the three preceding years: (a)

as of that date, the cost shall be reduced by the depreciation

Gross sales; (b) Cost of goods sold; (c) Gross profits; (d)

actually sustained before that date. [See R.S. 47:156(A).]

Percentage of profits to gross sales; (e) Amount collected;

and, (f ) Gross profit on amount collected. Print on Line 3

Subsequent improvements include expenditures for additions,

the gross profit on collections made during the current year.

improvements, and repairs made to restore the property or

[See R.S. 47:94(A).]

prolong its useful life. Do not include ordinary repairs, interest,

or taxes in computing gain or loss.

Line 4

Income (or loss) from Other Partnerships, Syndicates, etc.

Print the partnership’s distributive share (whether or not

No loss shall be recognized in any sale or other disposition

of shares of stock or securities where the partnership has

distributed) of the profits of another partnership’s capital

acquired, or contracted to acquire, substantially identical stock

gains or losses. If the distributive share is a loss, the loss is

or securities within 30 days before or after the date of such sale,

limited to the amount of the adjusted basis of such partner’s

unless the partnership is a dealer in stock or securities in the

interest in the other partnership at the end of the partnership

ordinary course of business.

year in which such loss occurred. If the taxable year of the

return filed does not coincide with the tax year of the other

Deduction for losses from sales or exchanges of capital assets

partnership, include the distributive share of the net profits

are allowed only to the extent of the gains from such sales or

(or losses) from the other partnership in the tax year in which

exchanges. (See R.S. 47:72.)

the other partnership’s tax year ends.

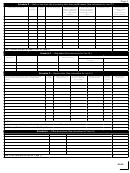

Line 10 Profit or Loss from Sale of Property Other Than Capital

Line 5

Dividends — Print on Line 5 all dividends (except certain

Assets — Print the profit or loss from the sales or exchanges

stock dividends) received from any corporation, regardless

of property other than capital assets reported on Schedule E

of whether or not the corporation has paid any income tax

of the return, and furnish the information required by the

to Louisiana.

Line 9 instructions.

Line 6

Interest — Print on Line 6 all interest received or credited to

Line 11 Other Income — Print any other taxable income and explain its

nature on an attached schedule, except items requiring separate

the partnership during the taxable period on bank deposits,

computation that are required to be reported on Schedule J.

notes, mortgages, corporation bonds, and bonds of states, cities,

Include taxable income from annuities and insurance proceeds.

and other political subdivisions. Do not include bonds issued

under authority granted by Acts of the Louisiana Legislature,

Line 12 Total Income — Add the amounts on Lines 3 through 11 and

if such Acts provide that the interest on such bonds shall be

print that amount on Line 12.

exempt from taxation.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12