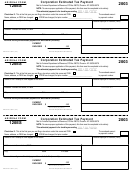

AZ Form 120W (2013)

Page 2 of 2

(a)

(b)

(c)

(d)

First 4

First 6

First 9

Entire

Months

Months

Months

Year

19 Enter taxable income for the following periods:

a Taxable year beginning in 2010 ........................................................................

19a

b Taxable year beginning in 2011 ........................................................................

19b

c Taxable year beginning in 2012 ........................................................................

19c

20 Divide the amount in each column on line 17a by the amount in column (d)

on line 19a ............................................................................................................

20

21 Divide the amount in each column on line 17b by the amount in column (d)

on line 19b ............................................................................................................

21

22 Divide the amount in each column on line 17c by the amount in column (d)

on line 19c ............................................................................................................

22

23 Add lines 20 through 22 ........................................................................................

23

24 Divide line 23 by three (3) .....................................................................................

24

25 Divide line 18 by line 24 ........................................................................................

25

26 Calculate the tax on the amount in each column on line 25 - see instructions .....

26

27 Divide the amount in columns (a) through (c) on line 19a by the amount in

column (d) on line 19a ..........................................................................................

27

28 Divide the amount in columns (a) through (c) on line 19b by the amount in

column (d) on line 19b ..........................................................................................

28

29 Divide the amount in columns (a) through (c) on line 19c by the amount in

column (d) on line 19c ..........................................................................................

29

30 Add lines 27 through 29 ........................................................................................

30

31 Divide line 30 by three (3) .....................................................................................

31

32 Multiply the amount in columns (a) through (c) of line 26 by the amount in the

corresponding column of line 31. In column (d), enter the amount from line 26,

column (d) .............................................................................................................

32

33 Enter tax from recapture of tax credits for each payment period - see instr. ........

33

34 Subtotal tax - add lines 32 and 33 ........................................................................

34

35 For each period, enter the amount of nonrefundable tax credits. See instr. .........

35

36 Arizona tax liability - subtract line 35 from line 34. If zero or less, enter zero ......

36

37 Refundable tax credits - see instructions ..............................................................

37

38 Claim of right adjustment - see instructions ..........................................................

38

39 Net liability - subtract the sum of line 37 and line 38 from line 36.

If zero or less, enter zero ......................................................................................

39

40 Multiply line 39 by 90% .........................................................................................

40

41 Add the amounts in all preceding columns from Part III, line 48 - see instr. .........

41

42 Adjusted seasonal installments. Subtract line 41 from line 40.

If zero or less, enter zero ......................................................................................

42

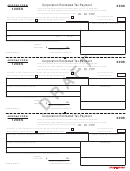

Part III - Required Installments

(a)

(b)

(c)

(d)

1st

2nd

3rd

4th

Installment

Installment

Installment

Installment

43 If only one of the above parts is completed, enter the amount in each column

from line 16 or line 42. (If both parts are completed, enter the smaller of the

amounts in each column from line 16 or line 42.) .................................................

43

44 Enter 25% of line 2d on Form 120W in each column. NOTE: “Large corporations”

see instr. for line 4, found on page 2 of the instructions, for the amount to enter ..........

44

45 Enter the amount from line 47 of this schedule for the preceding column ............

45

46 Add lines 44 and 45. Enter the total......................................................................

46

47 If line 46 is more than line 43, subtract line 43 from line 46. Otherwise, enter zero ...

47

48 Required Installments. Enter the smaller of line 43 or line 46 here and on

Form 120W, page 1, line 4....................................................................................

48

Print

ADOR 10551 (12)

1

1 2

2