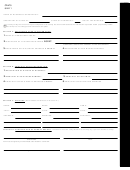

CD-479

Check List for Business Corporation Annual Report

8-24-11

(Instructions for the preparation of the Business Corporation Annual Report, Form CD-479)

The Annual Report Fee is $25.00

Use the checklist below in preparing the annual report for business corporations. Please take a few minutes and

read the information provided. The Business Corporation Annual Report due date is based on the corporation’s fiscal

year end. The annual report form is due by the 15th day of the 4th month following the business corporation’s fiscal

year end.

Taxpayers have the option of either filing the annual report in paper form with the Department of Revenue or in electronic form

online with the Secretary of State. If the corporation elects the file the annual report online with the Secretary of State's Office

the fee is $18.00 with a $2.00 electronic filing fee. The fee for filing with the Department of Revenue is $25.00. We strongly

encourage taxpayers to file the annual report electronically with the Secretary of State.

Limited Liability Companies (LLCs and Limited Liability Partnerships (LLPs) are not permitted to file an annual report with the

NC Department of Revenue and are to file online with the Secretary of State's Office.

Important: If this is your first annual report, it must be completed in its entirety including the Registered Agent’s signature.

If the corporation’s information has not changed since the most recently filed annual report, check the box, complete all

information above the check box and execute the document as indicated below. If you do not check the box, you must complete

the report in its entirety. An annual report without a checked box that is not completed in its entirety will be rejected.

The following information must be provided by each business corporation filing an Annual Report with the North

Carolina Department of Revenue:

Name of Corporation

Fiscal Year Ending

State of Incorporation

Secretary of State ID Number

A Brief Description of the Nature of the Business

The registered agent’s name, office mailing address, and office street address. The name of the registered agent must be typed or printed.

The registered office’s mailing address must be a North Carolina address and may be a Post Office Box. The street address must be a “Street

Address” and not a “Post Office Box”. The street address of the registered office must be a North Carolina address.

If the registered agent has changed, the new registered agent must sign consent to the appointment in the space provided. If the registered

agent’s name was changed due to marriage, or by any other legal means, the corporation must indicate such change in the space provided

and have the agent sign consent to the appointment under the new name. If the new registered agent is a business entity, then the appropriate

representative of that entity must sign and print their name and title. The registered agent must reside in North Carolina.

The principal office telephone number, mailing address, and street address. The principal office street address should reveal the

corporation’s physical location.

Every corporation must have at least one officer. Enter the complete name, title, and business address(es) of the principal officers. Use a

plain 8 1/2” x 11” sheet of paper if more space is needed. If more space is needed, the additional sheet(s) must be attached to the Annual

Report form.

Check the Annual Report carefully to ensure all information required for filing has been provided. Only an officer listed on the report may

sign. Complete the signature, date, typed or printed name and title in the spaces provided on the form to certify that the information is accurate

and current.If the Officer of the business corporation is another business entity, then the appropriate representative of that business entity must

certify the annual report by stating the business entity name, signing the person's name and providing the title and date.

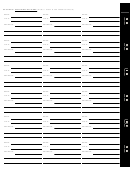

For more information or assistance, please contact:

An annual report may be downloaded

North Carolina Secretary of State

and/or filed online at the Secretary of

Corporations Division

State website:

Post Office Box 29525

Raleigh, NC 27626-0525

Phone (919) 807-2225

Toll Free (888) 246-7636

1

1 2

2 3

3