2

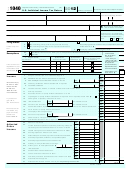

Form 1040A (2012)

Page

22

Enter the amount from line 21 (adjusted gross income).

22

Tax, credits,

{

}

Total boxes

23 a Check

You were born before January 2, 1948,

Blind

and

if:

Spouse was born before January 2, 1948,

Blind

checked

23a

▶

payments

b If you are married filing separately and your spouse itemizes

deductions, check here

23b

Standard

▶

Deduction

24

Enter your standard deduction.

24

for—

25

Subtract line 24 from line 22. If line 24 is more than line 22, enter -0-.

25

• People who

check any

26

Exemptions. Multiply $3,800 by the number on line 6d.

26

box on line

23a or 23b or

27

Subtract line 26 from line 25. If line 26 is more than line 25, enter -0-.

who can be

This is your taxable income.

27

claimed as a

▶

dependent,

28

Tax, including any alternative minimum tax (see instructions).

28

see

instructions.

29

Credit for child and dependent care expenses. Attach

• All others:

Form 2441.

29

Single or

30

Credit for the elderly or the disabled. Attach

Married filing

separately,

Schedule R.

30

$5,950

31

Education credits from Form 8863, line 19.

31

Married filing

jointly or

32

Retirement savings contributions credit. Attach

Qualifying

widow(er),

Form 8880.

32

$11,900

33

Child tax credit. Attach Schedule 8812, if required.

33

Head of

household,

34

Add lines 29 through 33. These are your total credits.

34

$8,700

35

Subtract line 34 from line 28. If line 34 is more than line 28, enter -0-. This is

your total tax.

35

36

Federal income tax withheld from Forms W-2 and

1099.

36

37

2012 estimated tax payments and amount applied

If you have

from 2011 return.

37

a qualifying

child, attach

38a Earned income credit (EIC).

38a

Schedule

b Nontaxable combat pay

EIC.

election.

38b

39

Additional child tax credit. Attach Schedule 8812.

39

40

American opportunity credit from Form 8863, line 8.

40

41

Add lines 36, 37, 38a, 39, and 40. These are your total payments.

41

▶

42

If line 41 is more than line 35, subtract line 35 from line 41.

Refund

This is the amount you overpaid.

42

43a Amount of line 42 you want refunded to you. If Form 8888 is attached, check here

43a

▶

Direct

deposit?

b Routing

c Type:

Checking

Savings

See

▶

▶

number

instructions

and fill in

d Account

43b, 43c,

▶

number

and 43d or

Form 8888.

44

Amount of line 42 you want applied to your

2013 estimated tax.

44

45

Amount you owe. Subtract line 41 from line 35. For details on how to pay,

Amount

see instructions.

45

▶

you owe

46

Estimated tax penalty (see instructions).

46

Third party

Yes. Complete the following.

No

Do you want to allow another person to discuss this return with the IRS (see instructions)?

designee

Designee’s

Phone

Personal identification

name

no.

number (PIN)

▶

▶

▶

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

Sign

and belief, they are true, correct, and accurately list all amounts and sources of income I received during the tax year. Declaration of preparer (other

than the taxpayer) is based on all information of which the preparer has any knowledge.

here

Your occupation

Daytime phone number

Your signature

Date

Joint return?

See instructions.

Spouse’s signature. If a joint return, both must sign.

Date

Spouse’s occupation

If the IRS sent you an Identity Protection

Keep a copy

PIN, enter it

for your records.

here (see inst.)

Paid

Print/type preparer's name

Preparer’s signature

Date

PTIN

Check

if

▶

self-employed

preparer

Firm's name

Firm's EIN

▶

▶

use only

Firm's address

Phone no.

▶

1040A

Form

(2012)

1

1 2

2