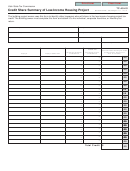

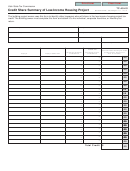

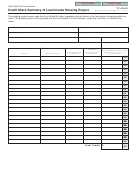

General Procedures and Instructions

The building owner must:

1) complete this form each year identifying the taxpayers who will share in the low-income housing project tax credit;

2) allocate the credit to each taxpayer who will receive a share in the building project;

3) attach this form to his individual, corporate franchise, or fiduciary tax return; and

4) keep a copy of this form and all related documents with his tax records.

A separate form TC-40LIS must be completed for each building project in a multiple building project.

Worksheet Instructions: This form is to be completed for the tax year in which the credit is allowed.

Column A:

List each individual or entity who will share in the low-income housing project tax credit.

Column B:

If the taxpayer in Column A is an individual enter their social security number. All others, enter their

employer identification number.

Column C:

List the percentage of the federal low-income housing credit allocated to each individual or entity in

Column A. The building project owner determines this percentage. Column C should total 100 percent.

Column D:

List the percentage of the state low-income housing credit allocated to each individual or entity in Column

A. The building project owner determines this percentage. Column D should total 100 percent.

Column E: This is the amount of the state tax credit allocated to the taxpayer in Column A for the current year building

project. This amount is calculated by taking the percentage in Column D and multiplying it by the annual

state low-income housing tax credit shown on line 4 of form TC-40TCAC. Column E should total Line 4 of

form TC-40TCAC.

1

1 2

2