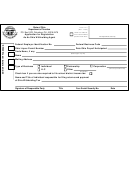

Form R-7 - Application For Enrollment As A Virginia Authorized Agent Page 2

ADVERTISEMENT

INSTRUCTIONS FOR FORM R-7

Application for Enrollment as a Virginia Authorized Agent

GENERAL

Purpose. Use Form R-7 to register with The Virginia Department of Taxation as a representative

or Authorized Agent for taxpayer(s). A Virginia Authorized Agent is not required to be an Enrolled

Agent or to first register with the Internal Revenue Service. The Virginia Authorized Agent will

be eligible to correspond with the Department of Taxation by phone or to receive correspondence,

documentation or other written materials that relate to specific tax matters for which a Virginia

Power of Attorney and Declaration of Representative form (PAR 101) has been filed.

PART I – REPRESENTATIVE INFORMATION

Change of Information – Check the box to indicate that this form is being submitted for changes

to name, address, phone number, fax number or e-mail address. Include the Virginia Authorized

Agent number only for change of information purposes.

Last Name – Enter the last name of the individual registering as the Authorized Agent

First Name - Enter the first name of the individual registering as the Authorized Agent

MI - Enter the middle initial of the individual registering as the Authorized Agent

NOTE: Enter your name exactly as it will appear on all Virginia Power of Attorney related

documents

Business Name – Enter the name of the business you represent. If you have no business affiliation,

leave blank.

FEIN – Enter the Federal Employer Identification Number of your business. Leave blank if your

business has no Federal Employer Identification Number.

Business Address – Enter the mailing address of your business where all correspondence should

be sent. If you do not represent a business, enter your personal mailing address. Mailing address

should include street name and number or post office box, city, state and Zip Code.

SSN – Enter your social security number or the last four digits of your social security number.

Federal CAF Number – Enter your Federal Central Authorization File number if applicable. If

you have no CAF number, leave blank.

PART II – SIGN HERE

Signature - You must sign the form. Your request for an Authorized Agent number will not be

processed until we receive a signed R-7 form.

Date – Enter the date that the R-7 form is signed.

Best Daytime Phone Number – Enter the phone number (including the area code) where you can

most easily be reached between 8:00 AM and 5:00 PM Monday thru Friday (EST).

FAX Number – Enter the daytime number where you receive faxed information. If there is no

convenient FAX number, leave blank.

E-mail Address – Enter the E-mail address where you receive business correspondence. If there is

no convenient E-mail address, leave blank.

NOTE: No personalized taxpayer correspondence or TAX information will be sent via e-mail

or FAX. These mediums will only be used for registration purposes and general information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2