Instructions For Form 1a - Annual Unemployment Tax Report

ADVERTISEMENT

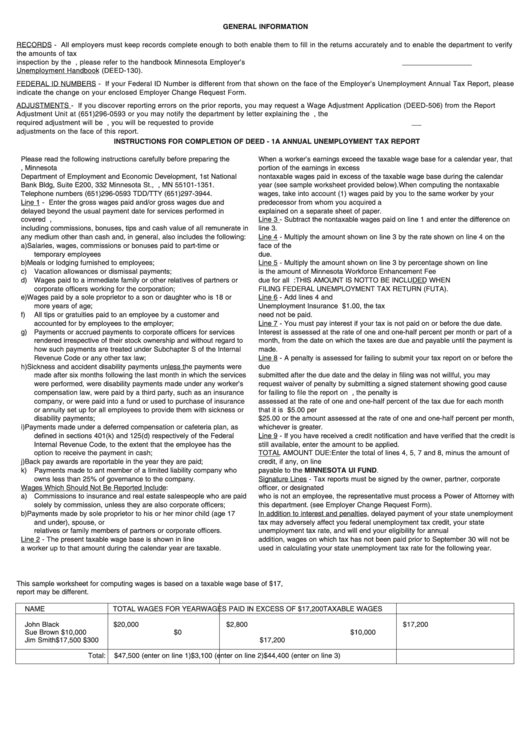

GENERAL INFORMATION

RECORDS - All employers must keep records complete enough to both enable them to fill in the returns accurately and to enable the department to verify

the amounts of tax due. Such records must be retained for a period of 8 years from the date the taxes are paid and at all times must be open for

inspection by the department. For additional information regarding reporting requirements, please refer to the handbook Minnesota Employer’s

Unemployment Handbook (DEED-130).

FEDERAL ID NUMBERS - If your Federal ID Number is different from that shown on the face of the Employer’s Unemployment Annual Tax Report, please

indicate the change on your enclosed Employer Change Request Form.

ADJUSTMENTS - If you discover reporting errors on the prior reports, you may request a Wage Adjustment Application (DEED-506) from the Report

Adjustment Unit at (651)296-0593 or you may notify the department by letter explaining the error. If the submitted wage information is complete, the

required adjustment will be made. If the information is incomplete, you will be requested to provide clarification. Please do not make prior year wage

adjustments on the face of this report.

INSTRUCTIONS FOR COMPLETION OF DEED - 1A ANNUAL UNEMPLOYMENT TAX REPORT

Please read the following instructions carefully before preparing the

When a worker’s earnings exceed the taxable wage base for a calendar year, that

report. Direct questions to the Employer Accounts Office, Minnesota

portion of the earnings in excess nontaxable. Enter on line 2 the total of

Department of Employment and Economic Development, 1st National

nontaxable wages paid in excess of the taxable wage base during the calendar

Bank Bldg, Suite E200, 332 Minnesota St., St. Paul, MN 55101-1351.

year (see sample worksheet provided below). When computing the nontaxable

Telephone numbers (651)296-0593 TDD/TTY (651)297-3944.

wages, take into account (1) wages paid by you to the same worker by your

Line 1 - Enter the gross wages paid and/or gross wages due and

predecessor from whom you acquired a business. Such items should be

delayed beyond the usual payment date for services performed in

explained on a separate sheet of paper.

covered employment. Wages means all remuneration for services,

Line 3 - Subtract the nontaxable wages paid on line 1 and enter the difference on

including commissions, bonuses, tips and cash value of all remunerate in

line 3.

any medium other than cash and, in general, also includes the following:

Line 4 - Multiply the amount shown on line 3 by the rate shown on line 4 on the

a) Salaries, wages, commissions or bonuses paid to part-time or

face of the report. This is the amount of Minnesota Unemployment Insurance Tax

temporary employees

due.

b) Meals or lodging furnished to employees;

Line 5 - Multiply the amount shown on line 3 by percentage shown on line 5. This

c)

Vacation allowances or dismissal payments;

is the amount of Minnesota Workforce Enhancement Fee due. This assessment is

d) Wages paid to a immediate family or other relatives of partners or

due for all employers. NOTE: THIS AMOUNT IS NOT TO BE INCLUDED WHEN

corporate officers working for the corporation;

FILING FEDERAL UNEMPLOYMENT TAX RETURN (FUTA).

e) Wages paid by a sole proprietor to a son or daughter who is 18 or

Line 6 - Add lines 4 and 5. This is the total tax due and payable to the Minnesota

more years of age;

Unemployment Insurance Fund. If the computed tax is less than $1.00, the tax

f)

All tips or gratuities paid to an employee by a customer and

need not be paid.

accounted for by employees to the employer;

Line 7 - You must pay interest if your tax is not paid on or before the due date.

g) Payments or accrued payments to corporate officers for services

Interest is assessed at the rate of one and one-half percent per month or part of a

rendered irrespective of their stock ownership and without regard to

month, from the date on which the taxes are due and payable until the payment is

how such payments are treated under Subchapter S of the Internal

made.

Revenue Code or any other tax law;

Line 8 - A penalty is assessed for failing to submit your tax report on or before the

h) Sickness and accident disability payments unless the payments were

due date. The penalty applies even if no tax payment is due. If your report is

made after six months following the last month in which the services

submitted after the due date and the delay in filing was not willful, you may

were performed, were disability payments made under any worker’s

request waiver of penalty by submitting a signed statement showing good cause

compensation law, were paid by a third party, such as an insurance

for failing to file the report on time. If there is no good cause, the penalty is

company, or were paid into a fund or used to purchase of insurance

assessed at the rate of one and one-half percent of the tax due for each month

or annuity set up for all employees to provide them with sickness or

that it is late. The minimum penalty is $5.00 per month. The maximum penalty is

disability payments;

$25.00 or the amount assessed at the rate of one and one-half percent per month,

i)

Payments made under a deferred compensation or cafeteria plan, as

whichever is greater.

defined in sections 401(k) and 125(d) respectively of the Federal

Line 9 - If you have received a credit notification and have verified that the credit is

Internal Revenue Code, to the extent that the employee has the

still available, enter the amount to be applied.

option to receive the payment in cash;

TOTAL AMOUNT DUE: Enter the total of lines 4, 5, 7 and 8, minus the amount of

j)

Back pay awards are reportable in the year they are paid;

credit, if any, on line 9. This is the total amount due. Please make Checks

k)

Payments made to ant member of a limited liability company who

payable to the MINNESOTA UI FUND.

owns less than 25% of governance to the company.

Signature Lines - Tax reports must be signed by the owner, partner, corporate

Wages Which Should Not Be Reported Include:

officer, or designated representative. If an employer appoints a representative

a) Commissions to insurance and real estate salespeople who are paid

who is not an employee, the representative must process a Power of Attorney with

solely by commission, unless they are also corporate officers;

this department. (see Employer Change Request Form).

b) Payments made by sole proprietor to his or her minor child (age 17

In addition to interest and penalties, delayed payment of your state unemployment

and under), spouse, or parent. This provision does not apply to

tax may adversely affect you federal unemployment tax credit, your state

relatives or family members of partners or corporate officers.

unemployment tax rate, and will end your eligibility for annual reporting. In

Line 2 - The present taxable wage base is shown in line 2. Wages paid to

addition, wages on which tax has not been paid prior to September 30 will not be

a worker up to that amount during the calendar year are taxable.

used in calculating your state unemployment tax rate for the following year.

This sample worksheet for computing wages is based on a taxable wage base of $17,200. The taxable wage base that appears on line 4 of your annual tax

report may be different.

NAME

TOTAL WAGES FOR YEAR

WAGES PAID IN EXCESS OF $17,200

TAXABLE WAGES

John Black

$20,000

$2,800

$17,200

Sue Brown

$10,000

$0

$10,000

Jim Smith

$17,500

$300

$17,200

Total:

$47,500 (enter on line 1)

$3,100 (enter on line 2)

$44,400 (enter on line 3)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1