Standard Form 2809 - Health Benefits Election Form Page 11

ADVERTISEMENT

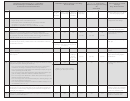

QLE’s That Permit

Change Permitted

Time Limits

Enrollment or Change

From Not

From Self

From One

When You Must File Health

Event

Event

Enrolled to

Only to Self

Plan or

Benefits Election Form With

Code

Enrolled

and Family

Option to

Your Employing Office

Another

3F

Former spouse or eligible child loses FEHB coverage due

Yes

Yes

Yes

From 31 days before through 60

to termination, cancellation, or change to Self Only of the

days after date of loss of coverage.

covering enrollment.

3G

Enrolled former spouse or eligible child loses coverage under

N/A

Yes

Yes

From 31 days before through 60

another group insurance plan; for example:

days after loss of coverage.

•

Loss of coverage under another federally-sponsored health

benefits program;

•

Loss of coverage due to termination of membership in the

employee organization sponsoring the FEHB plan;

•

Loss of coverage under Medicaid or similar State-

sponsored program (but see 3D and 3E);

•

Loss of coverage under a non-Federal health plan.

3H

Former spouse or eligible family member loses coverage due

N/A

Yes

Yes

During open season, unless OPM

to the discontinuance, in whole or part, of an FEHB plan.

sets a different time.

3I

Former spouse or covered family member in a Health

N/A

Yes

Yes

Upon notifying the employing

Maintenance Organization (HMO) moves or becomes

office of the move or change of

employed outside the geographic area from which the carrier

place of employment.

accepts enrollments, or if already outside this area, moves or

becomes employed further from this area.

3J

On becoming eligible for Medicare

N/A

No

Yes

At any time beginning the 30th

day before becoming eligible for

Medicare.

(This change may be made only once in a lifetime.)

3K

Former spouse’s annuity is insufficient to make FEHB with-

No

No

Yes

Retirement system will advise

holdings for plan in which enrolled.

former spouse of options.

4

Temporary Continuation of Coverage (TCC) For Eligible Former Employees, Former Spouses, and Children.

Note: Former spouse may change to Self and Family only if family members are also eligible family members of the employee or

annuitant.

4A

Opportunity to enroll for continued coverage under TCC

Within 60 days after the qualifying

provisions:

event, or receiving notice of

Yes

Yes

Yes

eligibility, whichever is later.

•

Former employee

Yes

N/A

N/A

•

Former spouse

Yes

N/A

N/A

•

Child who ceases to qualify as a family

member

4B

Open Season:

As announced by OPM.

No

Yes

Yes

•

Former employee

No

Yes

Yes

•

Former spouse

No

Yes

Yes

•

Child who ceases to qualify as a family

member

4C

Change in family status (except former spouse); for example,

No

Yes

Yes

From 31 days before through 60

marriage, birth or death of family member, adoption, legal

days after event.

separation, or divorce.

4D

Change in family status of former spouse, based on addition

No

Yes

Yes

From 31 days before through 60

of family members who are eligible family members of the

days after event.

employee or annuitant.

4E

Reenrollment of a former employee, former spouse, or child

May reenroll

N/A

N/A

From 31 days before through 60

whose TCC enrollment was terminated because of other

days after the event. Enrollment is

FEHB coverage and who loses the other FEHB coverage

retroactive to the date of the loss of

before the TCC period of eligibility (18 or 36 months)

the other FEHB coverage.

expires.

12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15