Clear All Pages

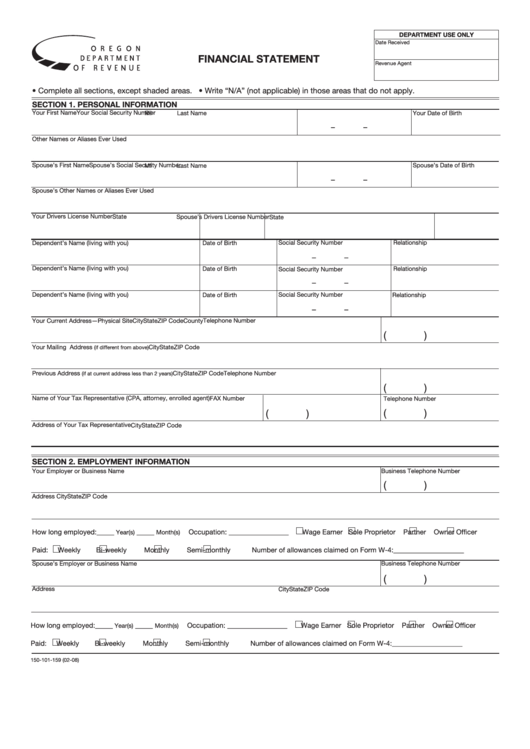

DEPARTMENT USE ONLY

Date Received

FINANCIAL STATEMENT

Revenue Agent

• Complete all sections, except shaded areas. • Write “N/A” (not applicable) in those areas that do not apply.

SECTION 1. PERSONAL INFORMATION

Your First Name

Your Social Security Number

MI

Last Name

Your Date of Birth

–

–

Other Names or Aliases Ever Used

Spouse’s First Name

Spouse’s Social Security Number

MI

Last Name

Spouse’s Date of Birth

–

–

Spouse’s Other Names or Aliases Ever Used

Your Drivers License Number

State

Spouse’s Drivers License Number

State

Dependent’s Name (living with you)

Date of Birth

Social Security Number

Relationship

–

–

Dependent’s Name (living with you)

Relationship

Date of Birth

Social Security Number

–

–

Dependent’s Name (living with you)

Date of Birth

Social Security Number

Relationship

–

–

Your Current Address—Physical Site

City

State

ZIP Code

County

Telephone Number

(

)

Your Mailing Address

City

State

ZIP Code

(if different from above)

Previous Address

City

State

ZIP Code

Telephone Number

(if at current address less than 2 years)

(

)

Name of Your Tax Representative (CPA, attorney, enrolled agent)

FAX Number

Telephone Number

(

)

(

)

Address of Your Tax Representative

City

State

ZIP Code

SECTION 2. EMPLOYMENT INFORMATION

Your Employer or Business Name

Business Telephone Number

(

)

Address

City

State

ZIP Code

How long employed:_____

_____

Occupation: _________________

Wage Earner

Sole Proprietor

Partner

Owner Officer

Year(s)

Month(s)

Paid:

Weekly

Bi-weekly

Monthly

Semi-monthly

Number of allowances claimed on Form W-4:____________________

Spouse’s Employer or Business Name

Business Telephone Number

(

)

Address

City

State

ZIP Code

How long employed:_____

_____

Occupation: _________________

Wage Earner

Sole Proprietor

Partner

Owner Officer

Year(s)

Month(s)

Paid:

Weekly

Bi-weekly

Monthly

Semi-monthly

Number of allowances claimed on Form W-4:____________________

150-101-159 (02-08)

1

1 2

2 3

3 4

4 5

5 6

6 7

7