Form Tt-385 - New York State Estate Tax Return

ADVERTISEMENT

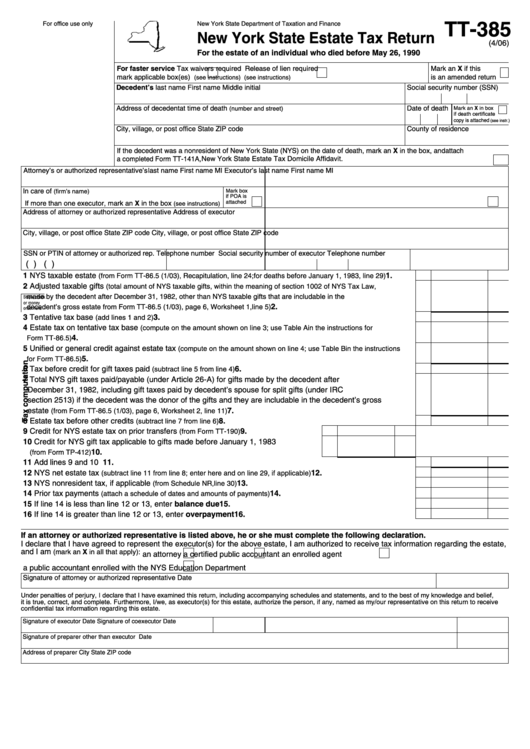

TT-385

For office use only

New York State Department of Taxation and Finance

New York State Estate Tax Return

(4/06)

For the estate of an individual who died before May 26, 1990

For faster service

Mark an X if this

Tax waivers required

Release of lien required

mark applicable box(es)

is an amended return

(see instructions)

(see instructions)

Decedent’s last name

First name

Middle initial

Social security number (SSN)

Address of decedent at time of death

Date of death

(number and street)

Mark an X in box

if death certificate

copy is attached

(see instr.)

City, village, or post office

State

ZIP code

County of residence

If the decedent was a nonresident of New York State (NYS) on the date of death, mark an X in the box, and attach

a completed Form TT-141A, New York State Estate Tax Domicile Affidavit.

Attorney’s or authorized representative’s last name

First name

MI

Executor’s last name

First name

MI

In care of

Mark box

(firm’s name)

if POA is

attached

If more than one executor, mark an X in the box

(see instructions)

Address of attorney or authorized representative

Address of executor

City, village, or post office

State

ZIP code

City, village, or post office

State

ZIP code

SSN or PTIN of attorney or authorized rep.

Telephone number

Social security number of executor

Telephone number

(

)

(

)

1 NYS taxable estate

......

1.

(from Form TT-86.5 (1/03), Recapitulation, line 24; for deaths before January 1, 1983, line 29)

2 Adjusted taxable gifts

(total amount of NYS taxable gifts, within the meaning of section 1002 of NYS Tax Law,

made by the decedent after December 31, 1982, other than NYS taxable gifts that are includable in the

Staple check

or money

2.

.......................................................

decedent’s gross estate from Form TT-86.5 (1/03), page 6, Worksheet 1, line 5)

order here.

3 Tentative tax base

3.

.................................................................................................................

(add lines 1 and 2)

4 Estate tax on tentative tax base

(compute on the amount shown on line 3; use Table A in the instructions for

...................................................................................................................................................

4.

Form TT-86.5)

5 Unified or general credit against estate tax

(compute on the amount shown on line 4; use Table B in the instructions

5.

..............................................................................................................................................

for Form TT-86.5)

6 Tax before credit for gift taxes paid

6.

............................................................................

(subtract line 5 from line 4)

7 Total NYS gift taxes paid/payable (under Article 26-A) for gifts made by the decedent after

December 31, 1982, including gift taxes paid by decedent’s spouse for split gifts (under IRC

section 2513) if the decedent was the donor of the gifts and they are includable in the decedent’s gross

estate

...........................................................................

7.

(from Form TT-86.5 (1/03), page 6, Worksheet 2, line 11)

8 Estate tax before other credits

8.

...................................................................................

(subtract line 7 from line 6)

9 Credit for NYS estate tax on prior transfers

9.

..............................

(from Form TT-190)

10 Credit for NYS gift tax applicable to gifts made before January 1, 1983

.............................................................................................. 10.

(from Form TP-412)

11 Add lines 9 and 10 ............................................................................................................................................ 11.

12 NYS net estate tax

........................................... 12.

(subtract line 11 from line 8; enter here and on line 29, if applicable)

13 NYS nonresident tax, if applicable

........................................................................... 13.

(from Schedule NR, line 30)

14 Prior tax payments

.............................................................. 14.

(attach a schedule of dates and amounts of payments)

15 If line 14 is less than line 12 or 13, enter balance due .................................................................................... 15.

16 If line 14 is greater than line 12 or 13, enter overpayment .............................................................................. 16.

If an attorney or authorized representative is listed above, he or she must complete the following declaration.

I declare that I have agreed to represent the executor(s) for the above estate, I am authorized to receive tax information regarding the estate,

and I am

(mark an X in all that apply):

an attorney

a certified public accountant

an enrolled agent

a public accountant enrolled with the NYS Education Department

Signature of attorney or authorized representative

Date

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete. Furthermore, I/we, as executor(s) for this estate, authorize the person, if any, named as my/our representative on this return to receive

confidential tax information regarding this estate.

Signature of executor

Date

Signature of coexecutor

Date

Signature of preparer other than executor

Date

Address of preparer

City

State

ZIP code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4