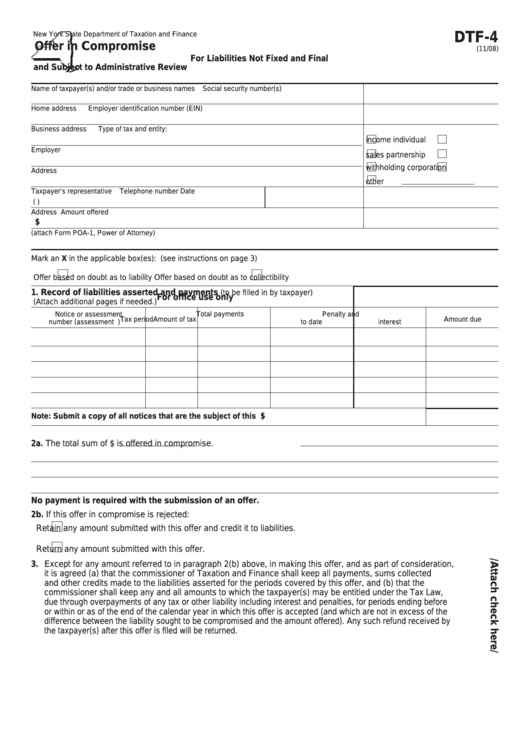

New York State Department of Taxation and Finance

DTF-4

Offer in Compromise

(11/08)

For Liabilities Not Fixed and Final

and Subject to Administrative Review

Name of taxpayer(s) and/or trade or business names

Social security number(s)

Home address

Employer identification number (EIN)

Business address

Type of tax and entity:

income

individual

Employer

sales

partnership

withholding

corporation

Address

other

Taxpayer’s representative

Telephone number

Date

(

)

Address

Amount offered

$

(attach Form POA‑1, Power of Attorney)

Mark an X in the applicable box(es):

(see instructions on page 3)

Offer based on doubt as to liability

Offer based on doubt as to collectibility

1. Record of liabilities asserted and payments

(to be filled in by taxpayer)

For office use only

(Attach additional pages if needed.)

Notice or assessment

Total payments

Penalty and

Tax period

Amount of tax

Amount due

number (assessment I.D.)

to date

interest

$

Note: Submit a copy of all notices that are the subject of this offer.

Total

2a. The total sum of $

is offered in compromise.

No payment is required with the submission of an offer.

2b. If this offer in compromise is rejected:

Retain any amount submitted with this offer and credit it to liabilities.

Return any amount submitted with this offer.

3. Except for any amount referred to in paragraph 2(b) above, in making this offer, and as part of consideration,

it is agreed (a) that the commissioner of Taxation and Finance shall keep all payments, sums collected

and other credits made to the liabilities asserted for the periods covered by this offer, and (b) that the

commissioner shall keep any and all amounts to which the taxpayer(s) may be entitled under the Tax Law,

due through overpayments of any tax or other liability including interest and penalties, for periods ending before

or within or as of the end of the calendar year in which this offer is accepted (and which are not in excess of the

difference between the liability sought to be compromised and the amount offered). Any such refund received by

the taxpayer(s) after this offer is filed will be returned.

1

1 2

2 3

3