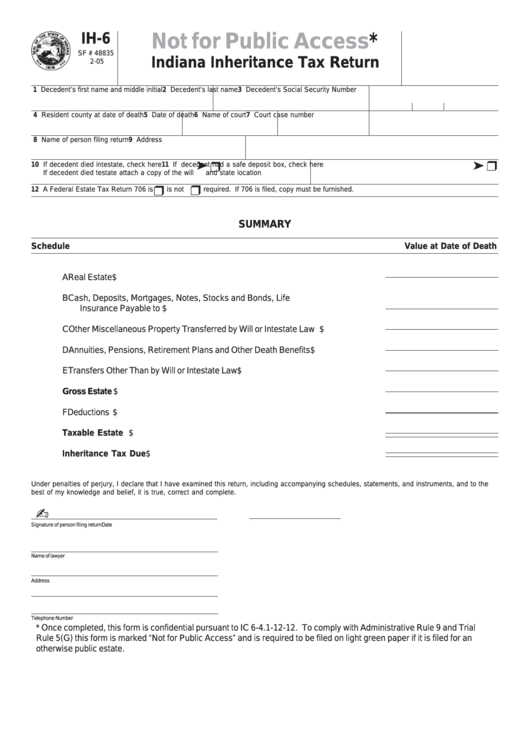

IH-6

Not for Public

Access*

SF # 48835

Indiana Inheritance Tax Return

2-05

1 Decedent’s first name and middle initial

2 Decedent’s last name

3 Decedent’s Social Security Number

4 Resident county at date of death

5 Date of death

6 Name of court

7 Court case number

8 Name of person filing return

9 Address

10 If decedent died intestate, check here

11 If decedent had a safe deposit box, check here

If decedent died testate attach a copy of the will

and state location

12 A Federal Estate Tax Return 706 is

is not

required. If 706 is filed, copy must be furnished.

SUMMARY

Schedule

Value at Date of Death

A

Real Estate ....................................................................................................... $

B

Cash, Deposits, Mortgages, Notes, Stocks and Bonds, Life

Insurance Payable to Estate ............................................................................ $

C

Other Miscellaneous Property Transferred by Will or Intestate Law ................... $

D

Annuities, Pensions, Retirement Plans and Other Death Benefits ..................... $

E

Transfers Other Than by Will or Intestate Law ................................................... $

Gross Estate ........................................................................................................... $

F

Deductions ....................................................................................................... $

Taxable Estate ...................................................................................................... $

Inheritance Tax Due ............................................................................................. $

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules, statements, and instruments, and to the

best of my knowledge and belief, it is true, correct and complete.

Signature of person filing return

Date

Name of lawyer

Address

Telephone Number

* Once completed, this form is confidential pursuant to IC 6-4.1-12-12. To comply with Administrative Rule 9 and Trial

Rule 5(G) this form is marked “Not for Public Access” and is required to be filed on light green paper if it is filed for an

otherwise public estate.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8