STATE OF ARKANSAS

CORPORATION INCOME TAX PAYMENT VOUCHER INSTRUCTIONS

IMPORTANT: This voucher must be fully completed and included with any payment made when filing

an original or amended tax return. Failure to complete a payment voucher could cause a delay in receiv-

ing credit for your payment. You must also use this payment voucher for filing prior year tax forms.

Paper Returns

If mailing a paper tax return with payment, complete Form AR1100CTV and include a check or money

order. Mail the AR1100CTV, payment, and your tax return (Form AR1100CT) to the PO Box listed below.

If this payment is for an amended return, mark “YES” on Form AR1100CTV in the appropriate space.

Arkansas State Income Tax

P.O. Box 919

Little Rock, AR 72203-0919

E-Filed Returns

If mailing a payment for a tax return that has been electronically filed, complete Form AR1100CTV and

include a check or money order. Mail the AR1100CTV and payment to:

Arkansas State Income Tax

P.O. Box 8149

Little Rock, AR 72203-8149

All tax return payments should be mailed on or before the due date of the tax return.

Note: Write your Federal Identification Number on your check or money order, and make payable in

U.S. Dollars to the Department of Finance and Administration.

For assistance, call (501) 682-4775

Click Here to Print Document

Click Here to Print Document

You must cut along the dotted line or the processing of your payment will be delayed.

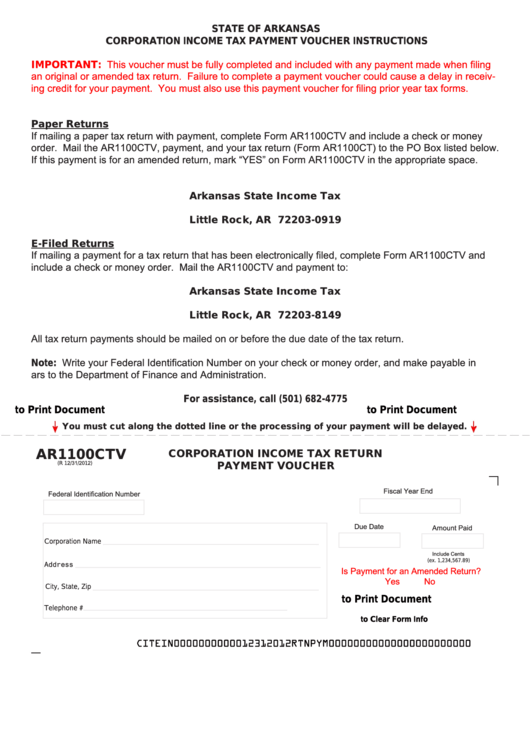

AR1100CTV

CORPORATION INCOME TAX RETURN

PAYMENT VOUCHER

(R 12/31/2012)

Fiscal Year End

Federal Identification Number

Due Date

Amount Paid

Corporation Name

Include Cents

(ex. 1,234,567.89)

Address

Is Payment for an Amended Return?

Yes

No

City, State, Zip

Click Here to Print Document

Telephone #

Click Here to Clear Form Info

CITEIN0000000000012312012RTNPYM00000000000000000000000

1

1