Worksheet Iii And Iv- Qualified Capital Gain Exclusion And Partial Pension And Annuity Income Exemption

ADVERTISEMENT

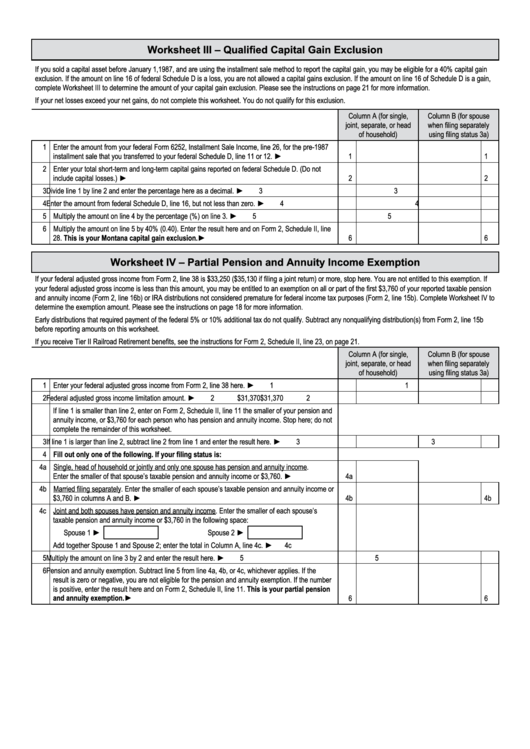

Worksheet III – Qualified Capital Gain Exclusion

If you sold a capital asset before January 1,1987, and are using the installment sale method to report the capital gain, you may be eligible for a 40% capital gain

exclusion. If the amount on line 16 of federal Schedule D is a loss, you are not allowed a capital gains exclusion. If the amount on line 16 of Schedule D is a gain,

complete Worksheet III to determine the amount of your capital gain exclusion. Please see the instructions on page 21 for more information.

If your net losses exceed your net gains, do not complete this worksheet. You do not qualify for this exclusion.

Column A (for single,

Column B (for spouse

joint, separate, or head

when filing separately

of household)

using filing status 3a)

1 Enter the amount from your federal Form 6252, Installment Sale Income, line 26, for the pre-1987

installment sale that you transferred to your federal Schedule D, line 11 or 12.

1

1

►

2 Enter your total short-term and long-term capital gains reported on federal Schedule D. (Do not

include capital losses.)

2

2

►

3 Divide line 1 by line 2 and enter the percentage here as a decimal.

3

3

►

4 Enter the amount from federal Schedule D, line 16, but not less than zero.

4

4

►

5 Multiply the amount on line 4 by the percentage (%) on line 3.

5

5

►

6 Multiply the amount on line 5 by 40% (0.40). Enter the result here and on Form 2, Schedule II, line

28. This is your Montana capital gain exclusion.

6

6

►

Worksheet IV – Partial Pension and Annuity Income Exemption

If your federal adjusted gross income from Form 2, line 38 is $33,250 ($35,130 if filing a joint return) or more, stop here. You are not entitled to this exemption. If

your federal adjusted gross income is less than this amount, you may be entitled to an exemption on all or part of the first $3,760 of your reported taxable pension

and annuity income (Form 2, line 16b) or IRA distributions not considered premature for federal income tax purposes (Form 2, line 15b). Complete Worksheet IV to

determine the exemption amount. Please see the instructions on page 18 for more information.

Early distributions that required payment of the federal 5% or 10% additional tax do not qualify. Subtract any nonqualifying distribution(s) from Form 2, line 15b

before reporting amounts on this worksheet.

If you receive Tier II Railroad Retirement benefits, see the instructions for Form 2, Schedule II, line 23, on page 21.

Column A (for single,

Column B (for spouse

joint, separate, or head

when filing separately

of household)

using filing status 3a)

1 Enter your federal adjusted gross income from Form 2, line 38 here.

1

1

►

2 Federal adjusted gross income limitation amount.

2

$31,370

$31,370

2

►

If line 1 is smaller than line 2, enter on Form 2, Schedule II, line 11 the smaller of your pension and

annuity income, or $3,760 for each person who has pension and annuity income. Stop here; do not

complete the remainder of this worksheet.

3 If line 1 is larger than line 2, subtract line 2 from line 1 and enter the result here.

3

3

►

4 Fill out only one of the following. If your filing status is:

4a Single, head of household or jointly and only one spouse has pension and annuity income.

Enter the smaller of that spouse’s taxable pension and annuity income or $3,760.

4a

►

4b Married filing separately. Enter the smaller of each spouse’s taxable pension and annuity income or

$3,760 in columns A and B.

4b

4b

►

4c Joint and both spouses have pension and annuity income. Enter the smaller of each spouse’s

taxable pension and annuity income or $3,760 in the following space:

Spouse 1 ►

Spouse 2 ►

Add together Spouse 1 and Spouse 2; enter the total in Column A, line 4c.

4c

►

5 Multiply the amount on line 3 by 2 and enter the result here.

5

5

►

6 Pension and annuity exemption. Subtract line 5 from line 4a, 4b, or 4c, whichever applies. If the

result is zero or negative, you are not eligible for the pension and annuity exemption. If the number

is positive, enter the result here and on Form 2, Schedule II, line 11. This is your partial pension

and annuity exemption.

6

6

►

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1