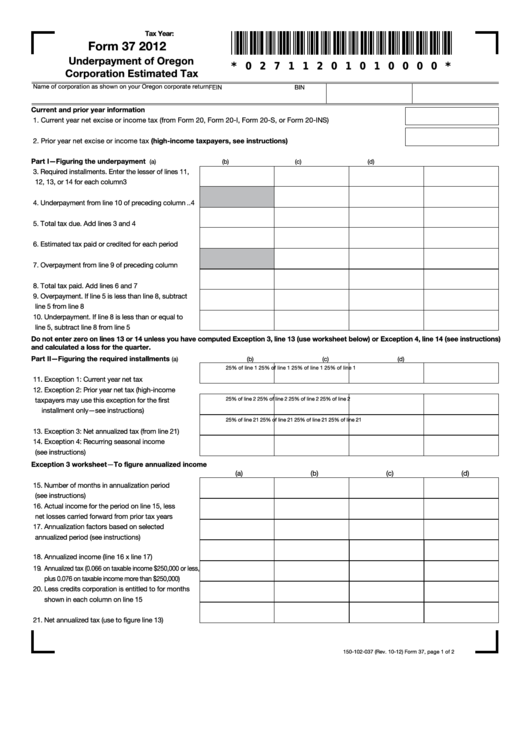

Clear Form

Tax Year:

Form 37 2012

Underpayment of Oregon

* 0 2 7 1 1 2 0 1 0 1 0 0 0 0 *

Corporation Estimated Tax

Name of corporation as shown on your Oregon corporate return

FEIN

BIN

Current and prior year information

1. Current year net excise or income tax (from Form 20, Form 20-I, Form 20-S, or Form 20-INS) ..................................1

2. Prior year net excise or income tax (high-income taxpayers, see instructions) .......................................................2

Part I—Figuring the underpayment

(a)

(b)

(c)

(d)

3. Required installments. Enter the lesser of lines 11,

12, 13, or 14 for each column .................................. 3

4. Underpayment from line 10 of preceding column ..4

5. Total tax due. Add lines 3 and 4.............................5

6. Estimated tax paid or credited for each period ......6

7. Overpayment from line 9 of preceding column ......7

8. Total tax paid. Add lines 6 and 7 ............................8

9. Overpayment. If line 5 is less than line 8, subtract

line 5 from line 8 ....................................................9

10. Underpayment. If line 8 is less than or equal to

line 5, subtract line 8 from line 5 ..........................10

Do not enter zero on lines 13 or 14 unless you have computed Exception 3, line 13 (use worksheet below) or Exception 4, line 14 (see instructions)

and calculated a loss for the quarter.

Part II—Figuring the required installments

(a)

(b)

(c)

(d)

25% of line 1

25% of line 1

25% of line 1

25% of line 1

11. Exception 1: Current year net tax .......................... 11

12. Exception 2: Prior year net tax (high-income

taxpayers may use this exception for the first

25% of line 2

25% of line 2

25% of line 2

25% of line 2

installment only—see instructions) ........................ 12

25% of line 21

25% of line 21

25% of line 21

25% of line 21

13. Exception 3: Net annualized tax (from line 21) ...... 13

14. Exception 4: Recurring seasonal income

(see instructions) .................................................14

Exception 3 worksheet—To figure annualized income

(a)

(b)

(c)

(d)

15. Number of months in annualization period

(see instructions) .................................................... 15

16. Actual income for the period on line 15, less

net losses carried forward from prior tax years .... 16

17. Annualization factors based on selected

annualized period (see instructions) ...................... 17

18. Annualized income (line 16 x line 17) .................... 18

19. Annualized tax (0.066 on taxable income $250,000 or less,

plus 0.076 on taxable income more than $250,000)...... 19

20. Less credits corporation is entitled to for months

shown in each column on line 15 .......................... 20

21. Net annualized tax (use to figure line 13) .............. 21

150-102-037 (Rev. 10-12) Form 37, page 1 of 2

1

1 2

2