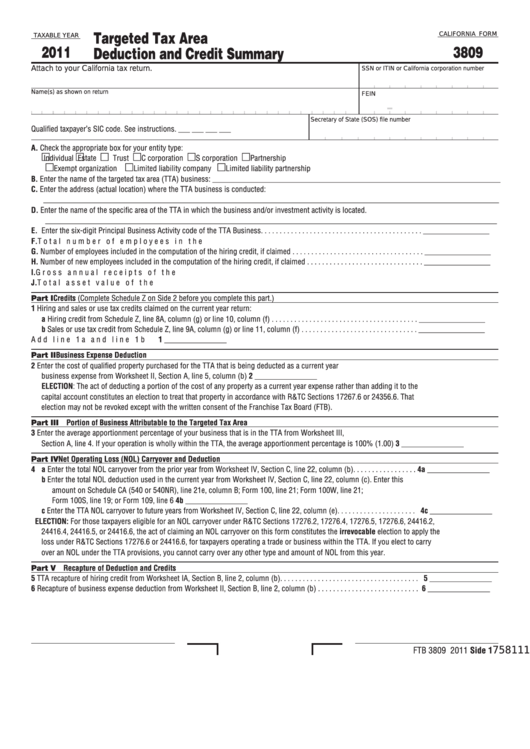

Targeted Tax Area

CALIFORNIA FORM

TAXABLE YEAR

2011

3809

Deduction and Credit Summary

Attach to your California tax return.

SSN or ITIN or California corporation number

Name(s) as shown on return

FEIN

Secretary of State (SOS) file number

Qualified taxpayer’s SIC code. See instructions. ___ ___ ___ ___

A. Check the appropriate box for your entity type:

Individual

Estate

Trust

C corporation

S corporation

Partnership

Exempt organization

Limited liability company

Limited liability partnership

B. Enter the name of the targeted tax area (TTA) business: __________________________________________________________________________

C. Enter the address (actual location) where the TTA business is conducted:

_____________________________________________________________________________________________________________________

D. Enter the name of the specific area of the TTA in which the business and/or investment activity is located.

____________________________________________________________________________________________________________________

E. Enter the six-digit Principal Business Activity code of the TTA Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________________

F. Total number of employees in the TTA. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________________

G. Number of employees included in the computation of the hiring credit, if claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________________

H. Number of new employees included in the computation of the hiring credit, if claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________________

I. Gross annual receipts of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________________

J. Total asset value of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________________

Part I Credits (Complete Schedule Z on Side 2 before you complete this part.)

1 Hiring and sales or use tax credits claimed on the current year return:

a Hiring credit from Schedule Z, line 8A, column (g) or line 10, column (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________________

b Sales or use tax credit from Schedule Z, line 9A, column (g) or line 11, column (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _________________

Add line 1a and line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 ________________

Part II Business Expense Deduction

2 Enter the cost of qualified property purchased for the TTA that is being deducted as a current year

business expense from Worksheet II, Section A, line 5, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 ________________

ELECTION: The act of deducting a portion of the cost of any property as a current year expense rather than adding it to the

capital account constitutes an election to treat that property in accordance with R&TC Sections 17267.6 or 24356.6. That

election may not be revoked except with the written consent of the Franchise Tax Board (FTB).

Part III Portion of Business Attributable to the Targeted Tax Area

3 Enter the average apportionment percentage of your business that is in the TTA from Worksheet III,

Section A, line 4. If your operation is wholly within the TTA, the average apportionment percentage is 100% (1.00) . . . . . . . . . 3 ________________

Part IV Net Operating Loss (NOL) Carryover and Deduction

4 a Enter the total NOL carryover from the prior year from Worksheet IV, Section C, line 22, column (b) . . . . . . . . . . . . . . . . . 4a ________________

b Enter the total NOL deduction used in the current year from Worksheet IV, Section C, line 22, column (c). Enter this

amount on Schedule CA (540 or 540NR), line 21e, column B; Form 100, line 21; Form 100W, line 21;

Form 100S, line 19; or Form 109, line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b ________________

c Enter the TTA NOL carryover to future years from Worksheet IV, Section C, line 22, column (e) . . . . . . . . . . . . . . . . . . . . . 4c ________________

ELECTION: For those taxpayers eligible for an NOL carryover under R&TC Sections 17276.2, 17276.4, 17276.5, 17276.6, 24416.2,

24416.4, 24416.5, or 24416.6, the act of claiming an NOL carryover on this form constitutes the irrevocable election to apply the

loss under R&TC Sections 17276.6 or 24416.6, for taxpayers operating a trade or business within the TTA. If you elect to carry

over an NOL under the TTA provisions, you cannot carry over any other type and amount of NOL from this year.

Part V Recapture of Deduction and Credits

5 TTA recapture of hiring credit from Worksheet IA, Section B, line 2, column (b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 ________________

6 Recapture of business expense deduction from Worksheet II, Section B, line 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 ________________

FTB 3809 2011 Side 1

7581113

1

1 2

2