Form Dr-501dv - Application For Homestead Tax Discount (Veterans Age 65 And Older With A Combat-Related Disability)

ADVERTISEMENT

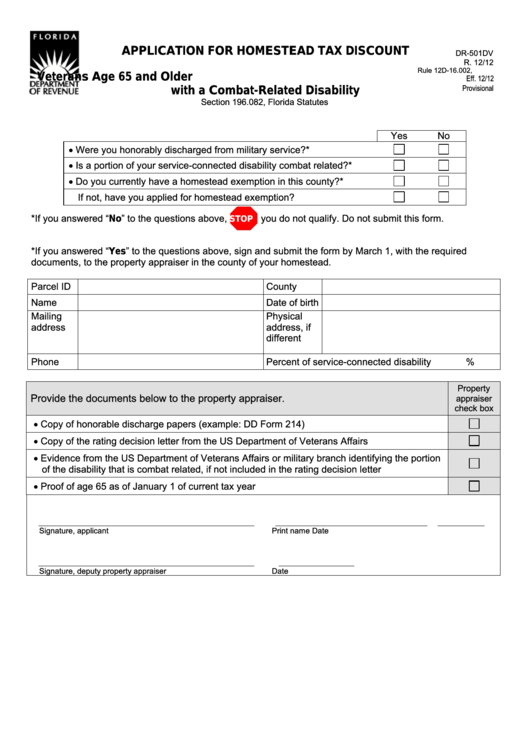

APPLICATION FOR HOMESTEAD TAX DISCOUNT

DR-501DV

R. 12/12

Rule 12D-16.002, F.A.C.

Veterans Age 65 and Older

Eff. 12/12

Provisional

with a Combat-Related Disability

Section 196.082, Florida Statutes

Yes

No

Were you honorably discharged from military service?*

Is a portion of your service-connected disability combat related?*

Do you currently have a homestead exemption in this county?*

If not, have you applied for homestead exemption?

*If you answered “No” to the questions above,

you do not qualify. Do not submit this form.

STOP

*If you answered “Yes” to the questions above, sign and submit the form by March 1, with the required

documents, to the property appraiser in the county of your homestead.

Parcel ID

County

Name

Date of birth

Mailing

Physical

address

address, if

different

Phone

Percent of service-connected disability

%

Property

Provide the documents below to the property appraiser.

appraiser

check box

Copy of honorable discharge papers (example: DD Form 214)

Copy of the rating decision letter from the US Department of Veterans Affairs

Evidence from the US Department of Veterans Affairs or military branch identifying the portion

of the disability that is combat related, if not included in the rating decision letter

Proof of age 65 as of January 1 of current tax year

Signature, applicant

Print name

Date

Signature, deputy property appraiser

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2