FYI - click mouse in 'Name' field to begin and tab throughout.

Print

Clear

DC

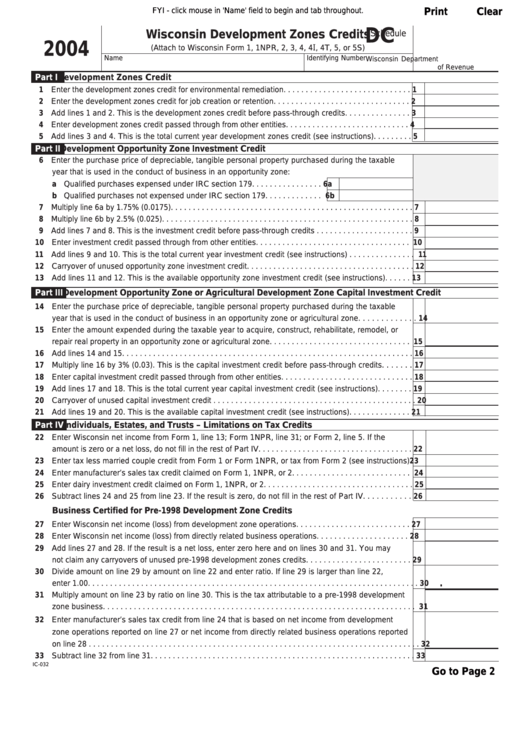

Wisconsin Development Zones Credits

Schedule

2004

(Attach to Wisconsin Form 1, 1NPR, 2, 3, 4, 4

I

, 4T, 5, or 5S)

Name

Identifying Number

Wisconsin Department

of Revenue

Par t I

Development Zones Credit

1 Enter the development zones credit for environmental remediation . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Enter the development zones credit for job creation or retention . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Add lines 1 and 2. This is the development zones credit before pass-through credits . . . . . . . . . . . . . . .

3

4 Enter development zones credit passed through from other entities . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Add lines 3 and 4. This is the total current year development zones credit (see instructions) . . . . . . . . .

5

Par t II

Development Opportunity Zone Investment Credit

6 Enter the purchase price of depreciable, tangible personal property purchased during the taxable

year that is used in the conduct of business in an opportunity zone:

a Qualified purchases expensed under IRC section 179 . . . . . . . . . . . . . . . . 6a

b Qualified purchases not expensed under IRC section 179 . . . . . . . . . . . . . 6b

7 Multiply line 6a by 1.75% (0.0175) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Multiply line 6b by 2.5% (0.025) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Add lines 7 and 8. This is the investment credit before pass-through credits . . . . . . . . . . . . . . . . . . . . . .

9

10 Enter investment credit passed through from other entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Add lines 9 and 10. This is the total current year investment credit (see instructions) . . . . . . . . . . . . . . . 11

12 Carryover of unused opportunity zone investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add lines 11 and 12. This is the available opportunity zone investment credit (see instructions) . . . . . . 13

Part III

Development Opportunity Zone or Agricultural Development Zone Capital Investment Credit

14 Enter the purchase price of depreciable, tangible personal property purchased during the taxable

year that is used in the conduct of business in an opportunity zone or agricultural zone . . . . . . . . . . . . . 14

15 Enter the amount expended during the taxable year to acquire, construct, rehabilitate, remodel, or

repair real property in an opportunity zone or agricultural zone . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Multiply line 16 by 3% (0.03). This is the capital investment credit before pass-through credits . . . . . . . 17

18 Enter capital investment credit passed through from other entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Add lines 17 and 18. This is the total current year capital investment credit (see instructions) . . . . . . . . 19

20 Carryover of unused capital investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Add lines 19 and 20. This is the available capital investment credit (see instructions) . . . . . . . . . . . . . . 21

Par t IV

Individuals, Estates, and Trusts – Limitations on Tax Credits

22 Enter Wisconsin net income from Form 1, line 13; Form 1NPR, line 31; or Form 2, line 5. If the

amount is zero or a net loss, do not fill in the rest of Part IV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Enter tax less married couple credit from Form 1 or Form 1NPR, or tax from Form 2 (see instructions) 23

24 Enter manufacturer’s sales tax credit claimed on Form 1, 1NPR, or 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Enter dairy investment credit claimed on Form 1, 1NPR, or 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Subtract lines 24 and 25 from line 23. If the result is zero, do not fill in the rest of Part IV . . . . . . . . . . . 26

Business Certified for Pre-1998 Development Zone Credits

27 Enter Wisconsin net income (loss) from development zone operations . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Enter Wisconsin net income (loss) from directly related business operations . . . . . . . . . . . . . . . . . . . . . 28

29 Add lines 27 and 28. If the result is a net loss, enter zero here and on lines 30 and 31. You may

not claim any carryovers of unused pre-1998 development zones credits . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Divide amount on line 29 by amount on line 22 and enter ratio. If line 29 is larger than line 22,

.

enter 1.00 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

31 Multiply amount on line 23 by ratio on line 30. This is the tax attributable to a pre-1998 development

zone business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Enter manufacturer’s sales tax credit from line 24 that is based on net income from development

zone operations reported on line 27 or net income from directly related business operations reported

on line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33 Subtract line 32 from line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

IC-032

Go to Page 2

1

1 2

2 3

3 4

4 5

5 6

6