Print

Clear

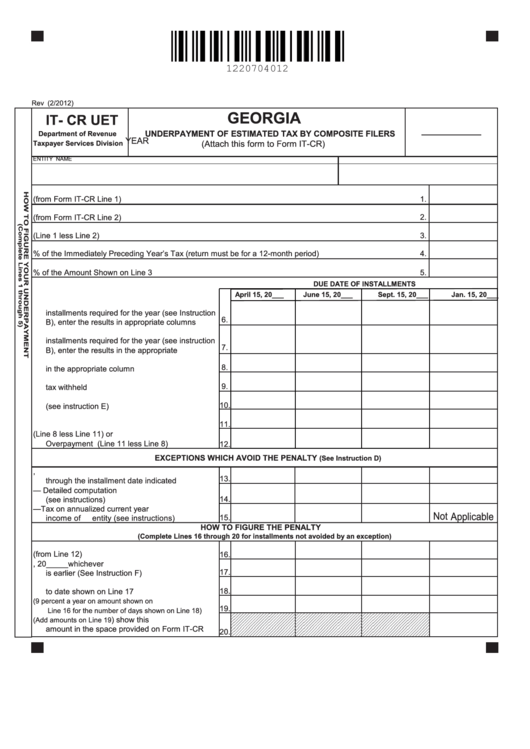

Rev (2/2012)

GEORGIA

IT- CR UET

UNDERPAYMENT OF ESTIMATED TAX BY COMPOSITE FILERS

Department of Revenue

YEAR

(Attach this form to Form IT-CR)

Taxpayer Services Division

ENTITY NAME

I.D. NUMBER

1. Tax (from Form IT-CR Line 1)

1.

2. Best Credits (from Form IT-CR Line 2)

2.

3. Balance Due (Line 1 less Line 2)

3.

4. Enter 100% of the Immediately Preceding Year’s Tax (return must be for a 12-month period)

4.

5. Enter 70% of the Amount Shown on Line 3

5.

DUE DATE OF INSTALLMENTS

April 15, 20___

June 15, 20___

Sept. 15, 20___

Jan. 15, 20___

6. Divide amount on Line 4 by the number of

installments required for the year (see Instruction

6.

B), enter the results in appropriate columns ........

7. Divide amount on Line 5 by the number of

installments required for the year (see instruction

7.

B), enter the results in the appropriate column....

8. Enter the lesser of line 6 or line 7 for each period

8.

in the appropriate column ...................................

9. Amounts paid on estimate for each period and

9.

tax withheld .........................................................

10.Overpayment of previous installment

10.

(see instruction E) ...............................................

11.

11.Total of Line 9 and Line 10 ..................................

12. Underpayment (Line 8 less Line 11) or

Overpayment (Line 11 less Line 8) ....................

12.

EXCEPTIONS WHICH AVOID THE PENALTY

(See Instruction D)

13. Total amount paid and withheld from January 1,

13.

through the installment date indicated ................

14. Exception 1. — Detailed computation

14.

(see instructions)..................................................

15. Exception 2. —Tax on annualized current year

Not

Applicable

15.

income of entity (see instructions).....................

HOW TO FIGURE THE PENALTY

(Complete Lines 16 through 20 for installments not avoided by an exception)

16. Amount of underpayment (from Line 12) ............

16.

17. Date of payment or April 15, 20_____whichever

17.

is earlier (See Instruction F) ..............................

18. Number of days from due date of installment

18.

to date shown on Line 17 ...................................

19. Penalty

(9 percent a year on amount shown on

19.

Line 16 for the number of days shown on Line 18).....

20. Penalty

) show this

(Add amounts on Line 19

amount in the space provided on Form IT-CR

20.

1

1 2

2