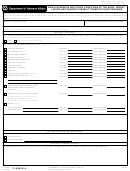

PART Vl - INFORMATION ABOUT THE NET WORTH OF YOU AND YOUR DEPENDENTS

NOTE: VA must generally consider all assets in determining eligibility for non service-connected pension. You must report net worth for yourself and all persons for whom you

are claiming benefits. VA cannot pay you a pension if your net worth is sizeable. Net worth is the market value of all interest and rights you have in any kind of property less any

mortgages, liens or other claims against the property. However, net worth does not include the house you live in or a reasonable area of land it sits on. Net worth also does not

include the value of personal things you use everyday like your vehicle, clothing, and furniture. VA does not allow anyone to transfer cash, property, or any other asset in order

to qualify for non service-connected pension. If property is owned jointly by yourself and your spouse, report one-half of the total Value Held jointly for each of you. You do not

reduce net worth for VA purposes as long as you maintain some right, privilege of ownership, benefit, or control of asset.

CHILD(REN)

For Items 28A through 28F, provide the amounts. If none, write "0" or "None."

Name

Name

Name

Name

(First, middle, last)

(First, middle, last)

(First, middle, last)

(First, middle, last)

SOURCE OF ASSETS

VETERAN

SPOUSE

$

$

$

$

$

$

28A. Cash, bank accounts,

Interest

Interest

Interest

Interest

Interest

Interest

certificates of deposit (CDs)

y

n

y

n

y

n

y

n

y

n

y

n

bearing:

bearing:

bearing:

bearing:

bearing:

bearing:

28B. IRAs, Keogh Plans, etc.

Interest

Interest

Interest

Interest

Interest

Interest

y

n

y

n

y

n

y

n

y

n

y

n

bearing:

bearing:

bearing:

bearing:

bearing:

bearing:

28C. Stocks, bonds, mutual funds

Interest

Interest

Interest

Interest

Interest

Interest

y

n

y

n

y

n

y

n

y

n

y

n

bearing:

bearing:

bearing:

bearing:

bearing:

bearing:

28D. Value of business assets

Interest

Interest

Interest

Interest

Interest

Interest

y

n

y

n

y

n

y

n

y

n

y

n

bearing:

bearing:

bearing:

bearing:

bearing:

bearing:

28E. Real property

(Not your home)

28F. All other property

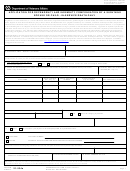

PART VlI - INFORMATION ABOUT TRANSFERRED ASSETS

NOTE - Provide the conditions of the transfer in Item 37, "Remarks," including any remaining right, privilege of ownership, benefit, or control you have over the asset.

29A. HAVE YOU TRANSFERRED ANY ASSETS IN THE LAST TWO (2) YEARS?

YES

NO

(If "Yes," provide the date of transfer___________________________ and the value $______________________)

29B. HAVE YOU TRANSFERRED ANY ASSET(S) AT ANY TIME IN EXCESS OF $20,000?

YES

NO

(If "Yes," provide the date of transfer___________________________ and the value $______________________)

PART VIlI - INFORMATION ABOUT YOU AND YOUR DEPENDENTS EXPECTED ANNUAL INCOME

IMPORTANT - Report payments from any source, unless the law says not to count them. Report all income and its sources and VA will determine whether to count it.

NOTE: Report the total amounts before you take out deductions for taxes, insurance, etc. Do not report the same information in both tables. If you expect to receive a payment,

but you don't know how much it will be, give your closest estimate in the space. If you do not receive any payments from one of the sources that we list, write "0" or "None" in

the space. If you are receiving monthly benefits, give us a copy of your most recent award letter. This will help us determine the amount of benefits we should pay you.

30. HAVE YOU CLAIMED OR ARE YOU RECEIVING DISABILITY BENEFITS FROM THE SOCIAL SECURITY ADMINISTRATION (SSA)?

YES

NO

MONTHLY INCOME - TELL US THE INCOME YOU AND YOUR DEPENDENTS RECEIVE EVERY MONTH

CHILD(REN)

Name

Name

Name

Name

(First, middle, last)

(First, middle, last)

(First, middle, last)

(First, middle, last)

SOURCE OF MONTHLY INCOME

VETERAN

SPOUSE

$

$

$

$

$

$

31A. Gross Wages & Salary

31B. Social Security

31C. U.S. Civil Service

31D. U.S. Railroad Retirement

31E. Military Retirement

31F. Black Lung Benefits

31G. Supplemental Security Income

(SSI)/Public Assistance

31H. Other income received

monthly (Please write source below)

Page 6

VA FORM 21-527, MAR 2012

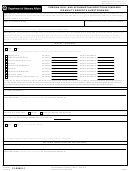

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8