Form Mf-400 - Kansas Qualified Agricultural Ethyl Alcohol Producer Incentive Fund Page 2

ADVERTISEMENT

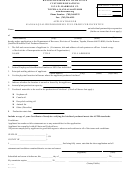

INSTRUCTIONS FOR COMPLETING APPLICATION FOR KANSAS QUALIFIED

AGRICULTURAL ETHYL ALCOHOL PRODUCER INCENTIVE FUND

1.

Complete this application and return to the Kansas Department of Revenue, Motor Fuel Tax,

915 S.W. Harrison Street, Topeka, Kansas 66625-8000.

2. Each question must be answered fully. Incomplete applications will be returned for completion.

3.

WHO MAY SIGN APPLICATION – Only the individual owner, one of the partners listed on

application, one of the executive officers listed, if applicant is a corporation; or a person who has been

duly authorized as attorney-in-fact by proper Power of Attorney which has been filed in this office, may

sign the application.

4. Applications must be properly notarized.

5. Upon acceptance, you will automatically be notified and will receive ethyl alcohol producer’s

Reports from the Department of Revenue on a quarterly basis.

MF-400

Rev. 07/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2