Part 3. Information About Your Presence in the United States

(Continued)

If you are unsure about any of your answers to questions 4(a)-(e) in Part 3 on Page 2, indicate which question(s) and explain why you are unsure

about the response(s) you have given: (Attach additional sheets of paper as needed.)

Part 4. Information About Your Financial Status and Employment

1. Provide information about the places where you have been employed for the last 10 years: (List PRESENT EMPLOYMENT FIRST and work back

in time. Include all employment, even if less than full-time. If you did the same type of work for three or more employers during any six-month

period and you do not know the names and addresses of those employers, you may state "multiple employers." Indicate the city or region where

you did the work, list the type of work you did, and estimate your earnings during that period. Any periods of unemployment, unpaid work (as a

homemaker or intern, for example), or school attendance should be specified.) (Attach additional sheets of paper as needed.)

Full Name and Address of Employer or School:

Earnings per Week:

Type of Work

Employed From:

Employed to:

(If self-employed, give name and address of business.)

(approximate)

Performed:

(Month/Year)

(Month/Year)

Present

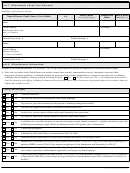

2. Provide information about your assets in the United States and other countries, including those held jointly with your spouse, if you are married,

or with others. Do not include the value of clothing and household necessities. If married, provide information about your spouse's assets that he

or she does not hold jointly with you: (Attach additional sheets of paper as needed.)

Self (Including assets jointly owned with spouse or others)

Spouse

Cash, Checking, or Savings Accounts:

Cash, Checking, or Savings Accounts:

$

$

Motor Vehicle(s):

Motor Vehicle(s):

(Minus any amount owed)

(Minus any amount owed)

$

$

Real Estate: (Minus any amount owed)

Real Estate: (Minus any amount owed)

$

$

Other:

Other:

(Describe below, e.g., stocks, bonds)

(Describe below, e.g., stocks, bonds)

$

$

Total:

Total:

$

$

3. Have you filed a Federal income tax return while in the United States?

Yes

No If "Yes," indicate the years you filed and attach

evidence that you filed the returns. If you did not file a tax return during any particular year(s), explain why you did not file: (Attach additional

sheets of paper as needed.)

Form I-881 07/08/11 Y Page 3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8