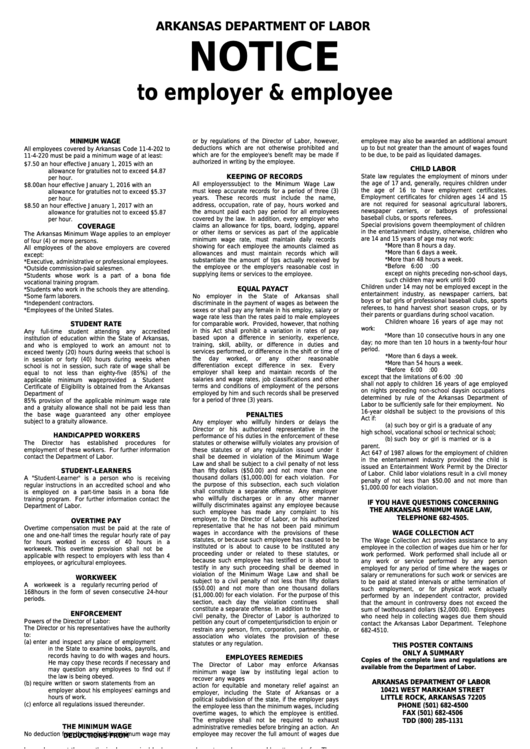

ARKANSAS DEPARTMENT OF LABOR

NOTICE

to employer & employee

MINIMUM WAGE

or by regulations of the Director of Labor, however,

employee may also be awarded an additional amount

deductions which are not otherwise prohibited and

up to but not greater than the amount of wages found

All employees covered by Arkansas Code 11-4-202 to

which are for the employee's benefit may be made if

to be due, to be paid as liquidated damages.

11-4-220 must be paid a minimum wage of at least:

authorized in writing by the employee.

$7.50

an hour effective January 1, 2015 with an

CHILD LABOR

allowance for gratuities not to exceed $4.87

KEEPING OF RECORDS

State law regulates the employment of minors under

per hour.

the age of 17 and, generally, requires children under

All employers subject to the Minimum Wage Law

$8.00

an hour effective January 1, 2016 with an

the age of 16 to have employment certificates.

must keep accurate records for a period of three (3)

allowance for gratuities not to exceed $5.37

Employment certificates for children ages 14 and 15

years.

These records must include the name,

per hour.

are not required for seasonal agricultural laborers,

address, occupation, rate of pay, hours worked and

$8.50

an hour effective January 1, 2017 with an

newspaper carriers, or batboys of professional

the amount paid each pay period for all employees

allowance for gratuities not to exceed $5.87

baseball clubs, or sports referees.

covered by the law. In addition, every employer who

per hour.

Special provisions govern the employment of children

claims an allowance for tips, board, lodging, apparel

COVERAGE

in the entertainment industry, otherwise, children who

or other items or services as part of the applicable

The Arkansas Minimum Wage applies to an employer

are 14 and 15 years of age may not work:

minimum wage rate, must maintain daily records

of four (4) or more persons.

*More than 8 hours a day.

showing for each employee the amounts claimed as

All employees of the above employers are covered

*More than 6 days a week.

allowances and must maintain records which will

except:

*More than 48 hours a week.

substantiate the amount of tips actually received by

*Executive, administrative or professional employees.

*Before 6:00 a.m. nor after 7:00 p.m.

the employee or the employer's reasonable cost in

*Outside commission-paid salesmen.

except on nights preceding non-school days,

supplying items or services to the employee.

*Students whose work is a part of a bona fide

such children may work until 9:00 p.m.

vocational training program.

Children under 14 may not be employed except in the

EQUAL PAY ACT

*Students who work in the schools they are attending.

entertainment industry, as newspaper carriers, bat

*Some farm laborers.

No employer in the State of Arkansas shall

boys or bat girls of professional baseball clubs, sports

*Independent contractors.

discriminate in the payment of wages as between the

referees, to hand harvest short season crops, or by

*Employees of the United States.

sexes or shall pay any female in his employ, salary or

their parents or guardians during school vacation.

wage rate less than the rates paid to male employees

Children who are 16 years of age may not

STUDENT RATE

for comparable work. Provided, however, that nothing

work:

in this Act shall prohibit a variation in rates of pay

Any full-time student attending any accredited

*More than 10 consecutive hours in any one

based upon a difference in seniority, experience,

institution of education within the State of Arkansas,

day; no more than ten 10 hours in a twenty-four hour

training, skill, ability, or difference in duties and

and who is employed to work an amount not to

period.

services performed, or difference in the shift or time of

exceed twenty (20) hours during weeks that school is

*More than 6 days a week.

the

day

worked,

or

any

other

reasonable

in session or forty (40) hours during weeks when

*More than 54 hours a week.

differentiation except difference in sex.

Every

school is not in session, such rate of wage shall be

*Before 6:00 a.m. nor after 11:00 p.m.

employer shall keep and maintain records of the

equal to not less than eighty-five (85%) of the

except that the limitations of 6:00 a.m. and 11:00 p.m.

salaries and wage rates, job classifications and other

applicable minimum wage provided a Student

shall not apply to children 16 years of age employed

terms and conditions of employment of the persons

Certificate of Eligibility is obtained from the Arkansas

on nights preceding non-school days in occupations

employed by him and such records shall be preserved

Department of Labor. Student workers subject to the

determined by rule of the Arkansas Department of

for a period of three (3) years.

85% provision of the applicable minimum wage rate

Labor to be sufficiently safe for their employment. No

and a gratuity allowance shall not be paid less than

16-year old shall be subject to the provisions of this

the base wage guaranteed any other employee

PENALTIES

Act if:

subject to a gratuity allowance.

Any employer who willfully hinders or delays the

(a)

such boy or girl is a graduate of any

Director or his authorized representative in the

high school, vocational school or technical school;

HANDICAPPED WORKERS

performance of his duties in the enforcement of these

(b)

such boy or girl is married or is a

The

Director

has

established

procedures

for

statutes or otherwise willfully violates any provision of

parent.

employment of these workers. For further information

these statutes or of any regulation issued under it

Act 647 of 1987 allows for the employment of children

contact the Department of Labor.

shall be deemed in violation of the Minimum Wage

in the entertainment industry provided the child is

Law and shall be subject to a civil penalty of not less

issued an Entertainment Work Permit by the Director

STUDENT-LEARNERS

than fifty dollars ($50.00) and not more than one

of Labor. Child labor violations result in a civil money

thousand dollars ($1,000.00) for each violation. For

A "Student-Learner" is a person who is receiving

penalty of not less than $50.00 and not more than

the purpose of this subsection, each such violation

regular instructions in an accredited school and who

$1,000.00 for each violation.

shall constitute a separate offense.

Any employer

is employed on a part-time basis in a bona fide

who willfully discharges or in any other manner

training program. For further information contact the

IF YOU HAVE QUESTIONS CONCERNING

willfully discriminates against any employee because

Department of Labor.

THE ARKANSAS MINIMUM WAGE LAW,

such employee has made any complaint to his

TELEPHONE 682-4505.

employer, to the Director of Labor, or his authorized

OVERTIME PAY

representative that he has not been paid minimum

Overtime compensation must be paid at the rate of

wages in accordance with the provisions of these

WAGE COLLECTION ACT

one and one-half times the regular hourly rate of pay

statutes, or because such employee has caused to be

The Wage Collection Act provides assistance to any

for hours worked in excess of 40 hours in a

instituted or is about to cause to be instituted any

employee in the collection of wages due him or her for

workweek.

This overtime provision shall not be

proceeding under or related to these statutes, or

work performed. Work performed shall include all or

applicable with respect to employers with less than 4

because such employee has testified or is about to

any work or service performed by any person

employees, or agricultural employees.

testify in any such proceeding shall be deemed in

employed for any period of time where the wages or

violation of the Minimum Wage Law and shall be

salary or remunerations for such work or services are

WORKWEEK

subject to a civil penalty of not less than fifty dollars

to be paid at stated intervals or at the termination of

A

workweek is a regularly recurring period of

($50.00) and not more than one thousand dollars

such employment, or for physical work actually

168 hours in the form of seven consecutive 24-hour

($1,000.00) for each violation. For the purpose of this

performed by an independent contractor, provided

periods.

section, each day the violation continues

shall

that the amount in controversy does not exceed the

constitute a separate offense.

In addition to the

sum of two thousand dollars ($2,000.00). Employees

ENFORCEMENT

civil penalty, the Director of Labor is authorized to

who need help in collecting wages due them should

Powers of the Director of Labor:

petition any court of competent jurisdiction to enjoin or

contact the Arkansas Labor Department. Telephone

The Director or his representatives have the authority

restrain any person, firm, corporation, partnership, or

682-4510.

to:

association who violates the provision of these

(a)

enter and inspect any place of employment

statutes or any regulation.

THIS POSTER CONTAINS

in the State to examine books, payrolls, and

ONLY A SUMMARY

records having to do with wages and hours.

EMPLOYEES REMEDIES

Copies of the complete laws and regulations are

He may copy these records if necessary and

The Director of Labor may enforce Arkansas

available from the Department of Labor.

may question any employees to find out if

minimum wage law by instituting legal action to

the law is being obeyed.

recover any wages due. An employee may bring an

ARKANSAS DEPARTMENT OF LABOR

(b)

require written or sworn statements from an

action for equitable and monetary relief against an

10421 WEST MARKHAM STREET

employer about his employees' earnings and

employer, including the State of Arkansas or a

hours of work.

LITTLE ROCK, ARKANSAS 72205

political subdivision of the state, if the employer pays

(c)

enforce all regulations issued thereunder.

PHONE (501) 682-4500

the employee less than the minimum wages, including

FAX (501) 682-4506

overtime wages, to which the employee is entitled.

DEDUCTIONS FROM

The employee shall not be required to exhaust

TDD (800) 285-1131

THE MINIMUM WAGE

administrative remedies before bringing an action. An

No deduction from the applicable minimum wage may

employee may recover the full amount of wages due

be made except those authorized or required by law

plus costs and a reasonable attorney’s fee. The

EMPLOYERS SUBJECT TO THE MINIMUM WAGE ACT ARE REQUIRED TO POST THIS NOTICE IN A CONSPICUOUS PLACE FOR ALL EMPLOYEES.

2/26/2015

1

1 2

2 3

3 4

4