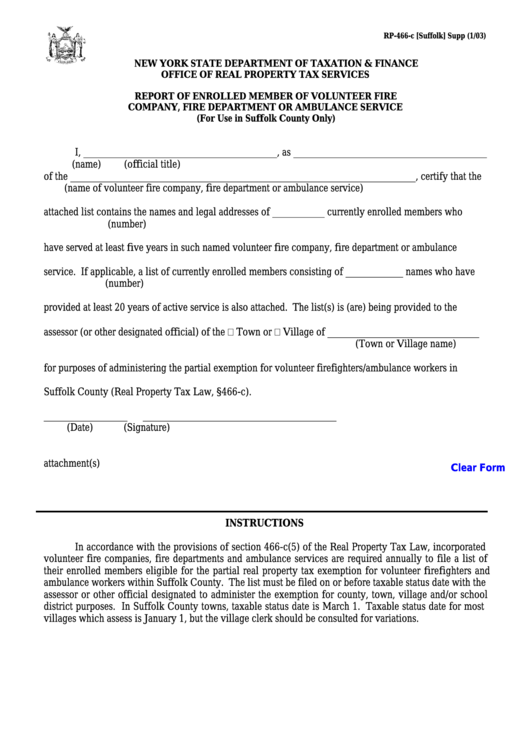

RP-466-c [Suffolk] Supp (1/03)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

REPORT OF ENROLLED MEMBER OF VOLUNTEER FIRE

COMPANY, FIRE DEPARTMENT OR AMBULANCE SERVICE

(For Use in Suffolk County Only)

I, _____________________________________, as _____________________________________

(name)

(official title)

of the __________________________________________________________________, certify that the

(name of volunteer fire company, fire department or ambulance service)

attached list contains the names and legal addresses of __________ currently enrolled members who

(number)

have served at least five years in such named volunteer fire company, fire department or ambulance

service. If applicable, a list of currently enrolled members consisting of ___________ names who have

(number)

provided at least 20 years of active service is also attached. The list(s) is (are) being provided to the

assessor (or other designated official) of the

Town or

Village of _____________________________

(Town or Village name)

for purposes of administering the partial exemption for volunteer firefighters/ambulance workers in

Suffolk County (Real Property Tax Law, §466-c).

________________

_____________________________________

(Date)

(Signature)

attachment(s)

Clear Form

INSTRUCTIONS

In accordance with the provisions of section 466-c(5) of the Real Property Tax Law, incorporated

volunteer fire companies, fire departments and ambulance services are required annually to file a list of

their enrolled members eligible for the partial real property tax exemption for volunteer firefighters and

ambulance workers within Suffolk County. The list must be filed on or before taxable status date with the

assessor or other official designated to administer the exemption for county, town, village and/or school

district purposes. In Suffolk County towns, taxable status date is March 1. Taxable status date for most

villages which assess is January 1, but the village clerk should be consulted for variations.

1

1

![Form Rp-466-c [putnam] - Application For Volunteer Firefighters / Volunteer Ambulance Workers Exemption Form Rp-466-c [putnam] - Application For Volunteer Firefighters / Volunteer Ambulance Workers Exemption](https://data.formsbank.com/pdf_docs_html/320/3204/320493/page_1_thumb.png)

![Form Rp-466-c [erie] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2008 Form Rp-466-c [erie] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2008](https://data.formsbank.com/pdf_docs_html/198/1984/198474/page_1_thumb.png)

![Form Rp-466-c [cattaraugus] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007 Form Rp-466-c [cattaraugus] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007](https://data.formsbank.com/pdf_docs_html/203/2034/203472/page_1_thumb.png)

![Form Rp-466-c [wyoming] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007 Form Rp-466-c [wyoming] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007](https://data.formsbank.com/pdf_docs_html/205/2053/205345/page_1_thumb.png)