Form Stmv 63 - Certificate Of Exemption To Purchase An Automobile For Lease Or Short-Term Rental

ADVERTISEMENT

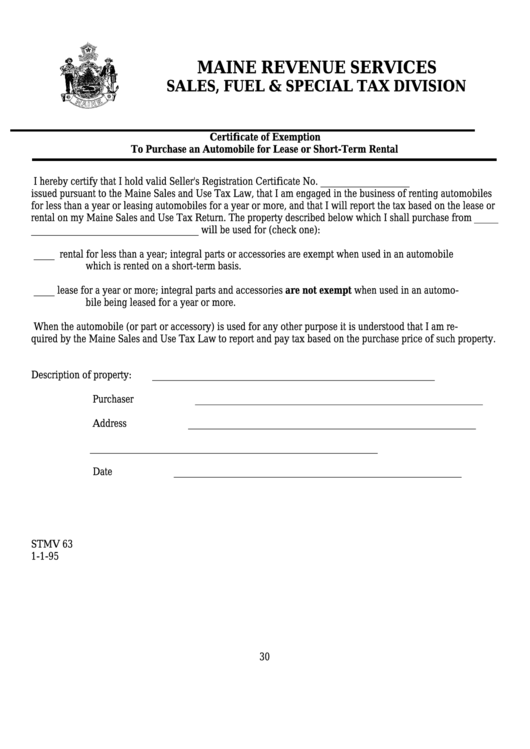

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

Certificate of Exemption

To Purchase an Automobile for Lease or Short-Term Rental

I hereby certify that I hold valid Seller's Registration Certificate No. _________________

issued pursuant to the Maine Sales and Use Tax Law, that I am engaged in the business of renting automobiles

for less than a year or leasing automobiles for a year or more, and that I will report the tax based on the lease or

rental on my Maine Sales and Use Tax Return. The property described below which I shall purchase from

________________________________ will be used for (check one):

____ rental for less than a year; integral parts or accessories are exempt when used in an automobile

which is rented on a short-term basis.

____ lease for a year or more; integral parts and accessories are not exempt when used in an automo-

bile being leased for a year or more.

When the automobile (or part or accessory) is used for any other purpose it is understood that I am re-

quired by the Maine Sales and Use Tax Law to report and pay tax based on the purchase price of such property.

Description of property:

______________________________________________________

Purchaser

_______________________________________________________

Address

_______________________________________________________

_______________________________________________________

Date

_______________________________________________________

STMV 63

1-1-95

30

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1