2

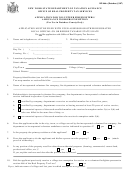

RP-466-b [Chautauqua, Oswego] (1/07)

CERTIFICATION

I certify that all statements made on this application are true and correct.

Signature of applicant (and spouse, if spouse also owns property)

_____________________________________________/_____________________________________(_________)

date

INSTRUCTIONS FOR APPLICATION FOR VOLUNTEER FIREFIGHTERS /

Clear Form

AMBULANCE WORKERS EXEMPTION IN CERTAIN ADDITIONAL COUNTIES

Authorization for exemption: Section 466-b of the Real Property Tax Law authorizes the governing body of a

county, c ity, t own or v illage i n a c ounty ha ving a p opulation of be tween 120,000 and 141,000 according to the

latest Federal decennial census (only Chautauqua and Oswego Counties currently satisfy this standard) to partially

exempt the residence of a volunteer firefighter or volunteer ambulance worker. The exemption does not apply to

school taxes.

Computation and duration of exemption: The exemption is available only to members of incorporated volunteer

fire c ompanies, f ire departments or incorporated v olunteer ambulance services who have be en certified as be ing

enrolled members for at least five years. The municipality determines the procedure for certification. In addition,

at local option of the county, city, town or village, the exemption may be granted for the life of an enrolled member

who has accrued more than 20 years of active service. At further local option, the exemption is also available to the

unmarried spouse of an enrolled member who was receiving the exemption when he or she was killed in the line of

duty. In addition, at local option, the exemption may be continued or reinstated for the un-remarried spouse of an

enrolled member who accrued at least 20 years of active service and was receiving the exemption prior to his or her

death.

The exemption may be granted only to applicants who reside in the city, town or village served by the fire

company, fire department or ambulance service. T he exemption is available only to the primary residence of the

applicant and only to property (or the portion thereof) exclusively used for residential purposes.

The exemption equals 10 percent of the assessed value of the property to a maximum of $3,000 multiplied

by the latest state equalization rate for the assessing unit in which the property is located. However, for village tax

purposes, w here the pr operty p reviously r eceived the $50 0 e xemption a uthorized by s ection 466 o f the R eal

Property Tax Law, the minimum exemption is $500.

Place and time of filing application: The a pplication m ust b e f iled annually i n the a ssessor’s o ffice (or ot her

official as de signated by t he m unicipality) on or before t axable status date. Taxable s tatus da te in m ost t owns,

including those within Chautauqua and Oswego Counties, is March 1. Taxable status date in cities is governed by

city cha rter. Taxable st atus da te f or m ost v illages which assess i s January 1, but t he v illage cl erk shoul d be

consulted f or v ariations. Proof of certification of enrolled m embership i n the f ire c ompany or de partment o r

ambulance service or status as un-remarried spouse of enrolled member killed in the line of duty or who served 20

years shall be as required by the county, city, town or village authorizing the exemption. Proof of ownership of the

property needs to be filed with the owner’s initial application. The assessor may request proof of primary residence

(e.g. voter’s registration, tax return).

FOR ASSESSOR’S USE

1. Date application filed: ______________

2. Taxable status date: ______________

3. Action on application:

Approved or

Disapproved

4. Amount of exemption:

County:

City/Town:

Village:

Assessor’s signature

Date

1

1 2

2

![Form Rp-466-b [chautauqua, Oswego]- Application For Volunteer Firefighters / Ambulance Workers Exemption In Certain Additional Counties - 2007 Form Rp-466-b [chautauqua, Oswego]- Application For Volunteer Firefighters / Ambulance Workers Exemption In Certain Additional Counties - 2007](https://data.formsbank.com/pdf_docs_html/198/1984/198464/page_1_thumb.png)