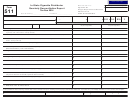

Form Pa-1 - State Cigarette P.a.c.t. Act Report Page 2

ADVERTISEMENT

General Information

Step-by-Step Instructions

What does the P.A.C.T. Act refer to?

Step 1: Identify your business

The Prevent All Cigarette Trafficking Act of 2009 is commonly

License number – write the license number or other identifi-

referred to as the PACT Act. Senate Bill 1147 was signed and

cation number issued to you by the state you are shipping into.

became public law 111-154.

Leave the line blank if the state you are shipping into does not

issue a specific license.

It is the purpose of this Act to:

• require Internet and other remote sellers of cigarettes

Step 2: Identify your sales

and smokeless tobacco to comply with the same laws

UPC – write the UPC carton code.

that apply to law-abiding tobacco retailers;

FEIN or License # – write the Federal Employers Identifica-

• create strong disincentives to illegal smuggling of

tion number (or Federal Identification number FTIN). If the

tobacco products;

buyer does not have either of these numbers, write the buyer's

• provide government enforcement officials with more

state cigarette license number. If you are making a delivery

effective enforcement tools to combat tobacco

sale to a consumer, leave this line blank.

smuggling;

Deliverer name, address and phone – complete only for

• make it more difficult for cigarette and smokeless

delivery sales and provide the information of the person who

tobacco traffickers to engage in and profit from their

delivered the cigarettes for you.

illegal activities;

• increase collections of Federal, State, and local excise

taxes on cigarettes and smokeless tobacco; and,

• prevent and reduce youth access to inexpensive

cigarettes and smokeless tobacco through illegal

Internet or contraband sales.

Who must file this report?

You must file this report if you advertise, offer for sale, sell,

transfer, or ship (for profit) cigarettes in interstate commerce.

These cigarettes must be shipped into another state, locality,

or Indian nation that taxes the sale or use of cigarettes.

When do I file?

The report is due no later than the 10

th

day of each calendar

month for the previous calendar month's shipments.

Where do I send the report?

A separate report should be sent to the cigarette tax adminis-

trator of each state into which shipments are made.

Mail to:

PA-1 (N-11/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2